Bearish Weather Sends NatGas Forwards Down Across Most of Curve

May natural gas forwards prices fell an average 9 cents between April 7 and 12 as overall bearish weather sentiment overshadowed the tight background supply/demand picture, according to NGI’s Forward Look.

Nymex futures led the way as moderate losses were seen through the winter 2017-2018 strip, while small gains were seen beginning with the summer 2018 strip. Nymex Henry Hub May futures slid 7.4 cents from Friday to Wednesday’s $3.187 settle as cash prices at the benchmark hub also softened, falling 21 cents during that time.

Beyond the front month, Nymex June futures dropped 7 cents to $3.26, the balance of summer (June to October) fell 6 cents to $3.34 and the winter 2017-2018 slipped 4 cents to $3.54. Further out, the Nymex summer 2018 strip climbed 3 cents to $2.90, while the winter 2018-2019 rose 2 cents to $3.10.

NGI is closed Friday in observance of the Good Friday holiday.

At the core of the week’s weakness at the front of the curve are bearish weather forecasts showing mostly mild temperatures across most of the United States in the weeks ahead. Forecaster NatGasWeather said mild to warm temperatures of 60s to 80s are expected in most areas over the next several days, except the West and portions of the far northern U.S. near the Canadian border where weather systems with rain and snow will track through.

In fact, data and analytics provider Genscape Inc. said its meteorologists had Lower 48 heating degree days (HDD) at 28.4 on April 12, nearly 70% below normal for this time of year. By the weekend, however, HDDs were forecast to move to zero, with the possibility of entering cooling degree day territory by Sunday.

“The possibility for notable cooling loads across the southern tier of the country from the Desert Southwest to the Southeast will likely be negated by the loss of heating loads across the Mid-Atlantic, Midwest, Northeast and New England,” Genscape said.

The Louisville, KY-based company said it projected total demand at 60.3 Bcf/d Wednesday and then bottoming out Saturday at 52.1 Bcf/d. On a more granular level, Midwest demand is projected to shed an average 0.78 Bcf/d through Saturday when demand there bottoms out at 7.55 Bcf/d. New England demand is projected to lose nearly 1.2 Bcf/d between Wednesday and Saturday when demand sinks to 2.09 Bcf/d. Northeast demand peaks Thursday at 9.6 Bcf/d before falling to a projected low of 6.4 Bcf/d on Sunday, Genscape said.

Beyond next week, NatGasWeather said the latest weather models have turned a bit cooler for the April 22-25 period, when a cold weather system is expected to sweep across the central United States, including deep into Texas, then shift eastward.

“It’s important to note there have been major weather model differences the past few days, with the GFS [Global Forecasting System] model being consistently a little colder than others, so this will require monitoring,” NatGasWeather said.

Meanwhile, Thursday’s storage report from the U.S. Energy Information Administration (EIA) was largely seen as a snoozer as the reported injection fell in line with market estimates. EIA reported a 10 Bcf build into storage inventories for the week ending April 7, elevating stocks to 2,061 Bcf. Stocks were 416 Bcf less than last year at this time and 263 Bcf above the five-year average of 1,798 Bcf.

Still, Wells Fargo analysts noted that the 10 Bcf injection was 17 Bcf greater than last year’s mark and 1 Bcf less than the five-year average of 11 Bcf, despite substantially warmer temperatures. HDDs for the U.S. last week came in at 92, 13% below the five-year average and 17% below the same period last year.

“Based on our storage model, the last four data points (including this most recent one) indicate that fundamentals are more than 2 Bcf/d undersupplied versus weather-adjusted historical averages. We forecast an aggregate inventory build of 1.747 Tcf (five-year average of 2.092 Tcf), and view peak storage levels entering withdrawal season at 3.798 Tcf, 82 Bcf below the five-year average,” Wells Fargo said after Thursday’s EIA report was released.

In order to finish the injection season at its forecast of just 3.8 Tcf, which is below historical levels, Wells Fargo said higher prices are necessary in order to destroy demand. “When compared with last year, we view stronger industrial demand (+0.9 Bcf/d), exports to Mexico (+0.8 Bcf/d), and LNG demand (+1.4 Bcf/d) mostly offsetting a modest supply increase (+0.4 Bcf/d) and weaker power demand (-3.5 Bcf/d),” the bank said.

The bulls appeared to be in charge Thursday as futures were several cents higher prior to the EIA weekly storage report. After it printed a build of +10 Bcf, which was in line with market expectations, prices chopped within a few cents, gradually sold off, but then rallied back.

“Prices tested $3.23 before selling off and are now back within a few cents of it, which we view as resistance since it was this price level where prices broke down from earlier in the week,” NatGasWeather said in its midday report.

The Nymex May contract ultimately settled Thursday at $3.227, up 4 cents on the day.

Taking a look at other markets across the U.S., Northeast points suffered more substantial losses across the curve than other regions, although declines were less than 15 cents across the curve.

At Dominion, May forward prices tumbled 20 cents between April 7 and 12 to reach $2.63, according to Forward Look. June and balance of summer (June to October) prices also fell around 20 cents to reach $2.62 and $2.66, respectively. Further out the curve, the Dominion winter 2017-2018 forward strip was down 9 cents to $3.02, while the summer 2018 was down just 3 cents to $2.30.

Very similar patterns played out at both Dominion North and Dominion South, two new points added during the week to NGI’s Forward Look. The Dominion price point, going forward, will represent a combined price in the North and South zones.

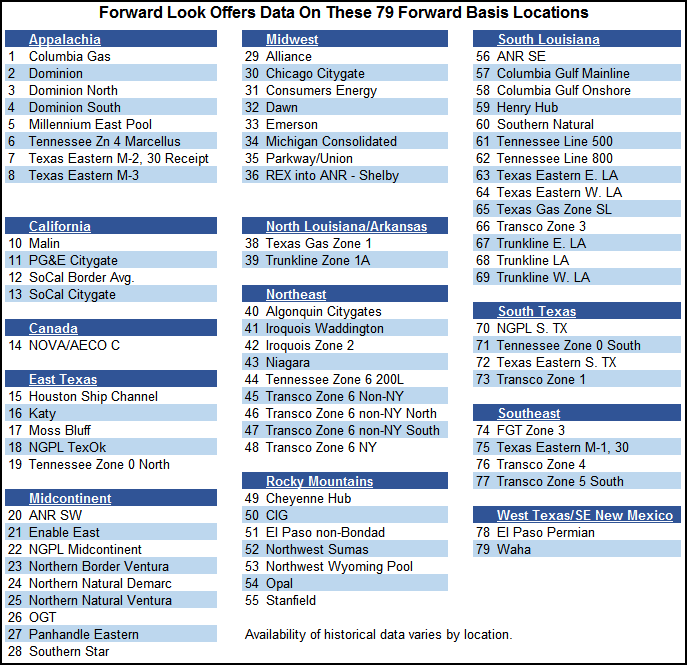

“As part of our continual efforts to enhance market visibility, NGI has increased the number of forward basis locations published in its Forward Look. This latest buildout adds 26 new locations, bringing the total number to 79,” NGI Markets Analyst Nate Harrison said.

Meanwhile, Algonquin Gas Transmission Citygates put up steep declines during the summer months as season-long maintenance is under way on the New England pipeline. In fact, just Thursday, Algonquin reported an unexpected failure at the Cromwell Compressor in Middlesex, CT, that will necessitate a capacity reduction. This comes amid existing reductions at Stony Point for planned maintenance.

Algonquin said the Cromwell failure will restrict capacity to 1,107 MMcf/d, a 130 MMcf/d decrease from the normal 1,237 MMcf/d. No end date has yet been provided.

Nominated flows through Cromwell today are at 1,033 MMcf/d, but have been as high as 1,220 MMcf/d in the past 14 days, according to Genscape. “Part of the reason Cromwell flows have not been fully at capacity is because of planned maintenance upstream at Stony Point, NY. Work there has reduced capacity to as low as 1,186 MMcf/d in the past two weeks (normal is 1,811 MMcf/d), with flows through that point mostly filling the available maintenance-restricted capacity,” Genscape said.

While restrictions could provide moderate lift to Algonquin Gas Transmission (AGT) Citygate prices depending on their duration, warming temperatures in New England and near-full storage inventories at Everett LNG may counter some of the effect.

AGT May forward prices fell 15 cents from April 7 to 12 to reach $3.04, June dropped 15 cents to $3.10 and the balance of summer (June to October) slid 14 cents to $3.26, Forward Look data shows. Smaller declines were seen beyond that, with the winter 2017-2018 slipping just 4 cents during that time to $7.03 and the summer 2018 strip holding steady at $2.82.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 |