Another Rig Returns to Haynesville Shale

Liquids-rich stacked plays in Texas and Oklahoma have been getting most of the trade press ink — and most of the rigs — of late. Meanwhile, the Haynesville Shale is twitching back to life, with some expecting big things from the North Louisiana dry gas play.

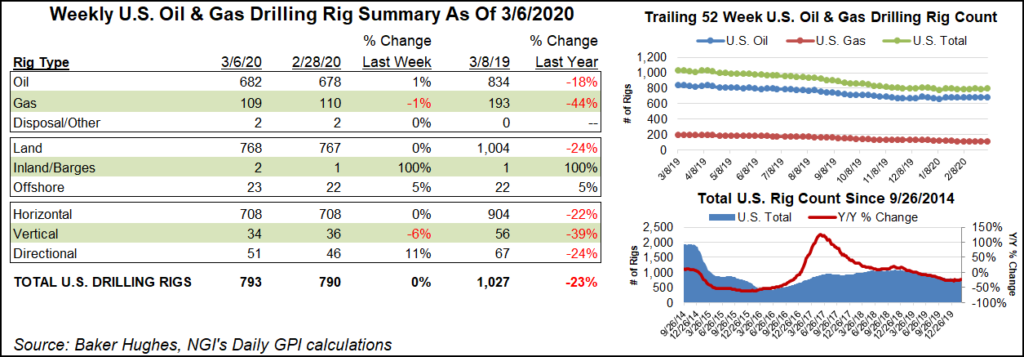

One rig came back to the Haynesville during the week ending Oct. 21, according to Baker Hughes Inc. (BHI). There were 17 rigs running in the Haynesville as of Friday, which is still down by nine from a year ago, but rigs have been creeping back (see Daily GPI, Oct. 7).

Last Monday Comstock Resources Inc. said it was selling up in South Texas, taking the proceeds and spending them in the Haynesville (see Shale Daily, Oct. 17). The week before an executive with BP Energy said the Haynesville is becoming more attractive to drillers, partly because it is near petrochemical gas demand and liquefied natural gas export terminals (see Shale Daily, Oct. 14).

Still, the latest BHI rig report was mostly about oil and mostly about the Permian.

Fifteen U.S. land-based rigs came back to the oil/gas hunt during the week ending Oct. 21, according to BHI. All of them were horizontals and nearly all were targeting the Permian Basin.

One rig left the inland waters, so the net U.S. gain was 14 units. Eleven rigs came back to the Permian, lifting its tally to 212, which is not all that far from the year-ago census of 229. Ten rigs came back to Texas, giving the Lone Star State 254 actives, not quite 100 fewer than one year ago when 346 were running. Wyoming added three rigs and New Mexico added two.

Oil rigs led the charge, outnumbering returning natural gas units 11 to 3. Canada dropped 21 oil rigs and one gas unit, bringing the country’s total of active rigs down by 22 to rest at 143 active. Canadian declines offset U.S. gains for a North American rig tally of 696, down eight units from a week prior.

Deal-making in the Permian has been on the rise recently, too. “Over the past few months we’ve seen a wave of Permian deals and the pace of deal-flow does not appear to be subsiding,” analysts at Wells Fargo Securities said in a note Tuesday. “Recently, production-adjusted purchase prices have averaged over $30,000 per net acre, which largely reflects the unique stacked-pay potential in the Permian.

“While we recognize the need to maintain/grow inventory, acreage prices remain elevated, at least in the Permian, which could infringe upon full cycle economics, and require accelerated drilling, improved recovery factors, and/or higher commodity prices to justify acreage prices being paid.”

Denver-based SM Energy Co. recently did a $1.6 billion deal in the Permian (see Shale Daily, Oct. 18). Just before that, RSP Permian Inc. did a $2.4 billion deal (see Shale Daily, Oct. 14).

For more on the Permian, see NGI’s special report Permian Basin: ”The Mother Lode’.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |