Regulatory | LNG | NGI All News Access

LNG Won’t Drain All of Canada’s Gas, Former Chief Regulator Assures

Canada will have adequate natural gas supplies despite appearances of over-commitment to overseas markets for liquefied natural gas (LNG), the National Energy Board (NEB) has been assured by one of its former chairmen.

The NEB should have “substantial confidence that not all LNG export licenses will be used or used to their full allowance,” independent industry consultant Roland Priddle said in a report completed for a tanker terminal project on the Pacific Coast of British Columbia (BC), Cedar LNG.

The report responds to questions raised before the NEB by a still-growing wave of tanker terminal schemes proposed since 2009 as escape routes for the Canadian supply industry from shale production surpluses and low gas prices across North America.

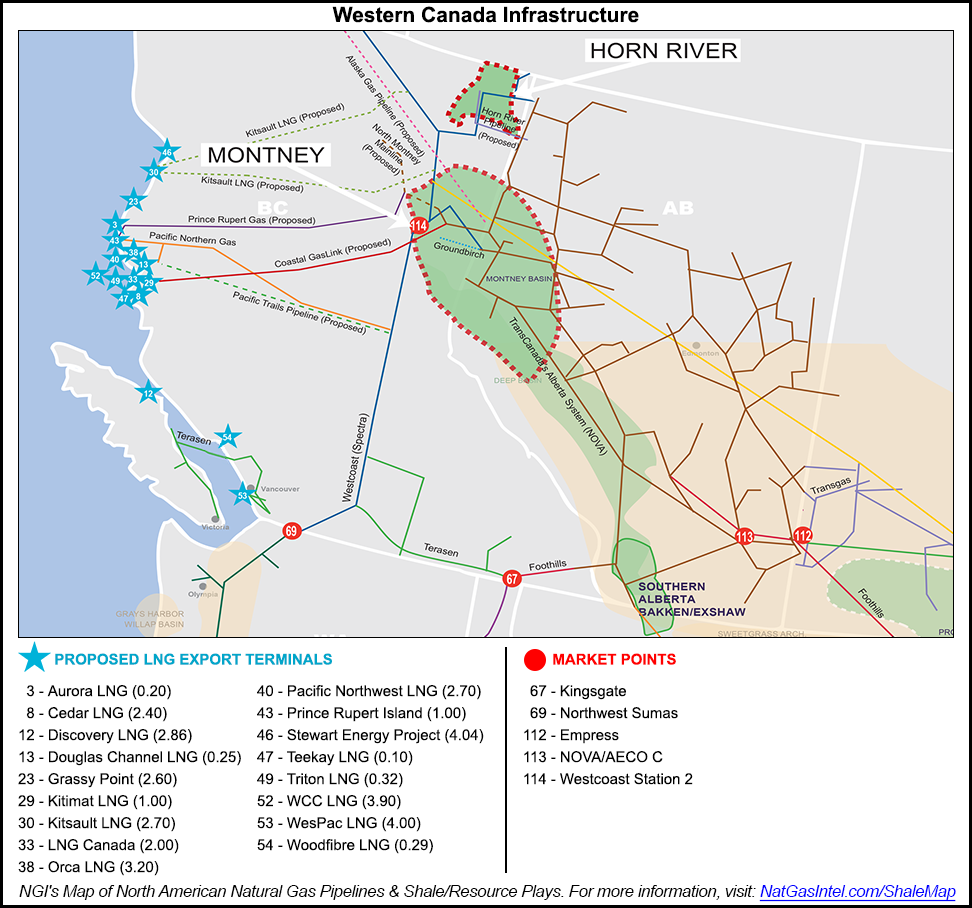

In the lineup so far, 26 projects have applied for 20- to 40-year NEB export licenses: 21 on the Pacific Coast, including two Oregon plans to ship out BC gas, and five Atlantic outlets, including two in Nova Scotia, two in Quebec and one in New Brunswick.

If all the schemes went ahead to their full capacity, the total volume of Canadian gas dedicated to overseas trade would hit an astronomical 444 Tcf, loaded onto tankers at a rate of 45 Bcf/d.

To date, the NEB has awarded 17 long-term export licenses for a total of up to 304 Tcf, to be loaded into tankers at a rate of up to 31 Bcf/d.

The LNG ambitions dwarf the historical performance of Canadian supplies. National production for all domestic and export markets peaked at 17 Bcf/d in 2005. The export record for pipeline deliveries to the United States, set in 2007, stands at 10.6 Bcf/d.

With Priddle as chairman in the late 1980s and early 1990s, the NEB abolished an export “surplus test” that made industry juggle decades-long supply and demand forecasts in order to establish volumes available for exports after satisfying Canadian needs. But the board still has a federally legislated mandate to assess whether proposed export gas licenses threaten to erode supplies retained for reasonably foreseeable Canadian requirements after taking industry development trends into account.

In rating LNG as no threat, Priddle recited a sobering list of 15 formidable obstacles and risks facing the lineup of export projects that highlights reasons why none of them have been built yet and only the fittest few are expected to make it into construction:

But Priddle pointed out that all North American contenders that would break into the international gas trade face emerging new, low-cost rivals on the global energy scene.

“In less than five years, the east African deep offshore in Mozambique and Tanzania has developed into a major source of potential LNG for Asian markets,” Priddle said.

He cited specialist reports that “indicate potential reserves of as much as 100 Tcf in Mozambique and 50 Tcf in Tanzania. More than 60 million tonnes of LNG capacity, equivalent to some eight Bcf/d, are in the planning stage.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |