NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

NOV’s Rig Systems Backlog Drops 17%; Customers ‘Very Aggressive’

National Oilwell Varco Inc. (NOV), which designs, manufactures and sells equipment and components used across the drilling spectrum, saw a reversal of fortune in the final three months of 2014, as the backlog for orders in its Rig Systems segment plunged by 17% from a year ago and declined by 13% sequentially.

“Orders for all our products had slowed sharply,” CEO Clay Williams said during a quarterly conference call Tuesday. “Offshore and land drilling, completion and production, customers are delaying purchases of both capital and consumables wherever possible, seeking to conserve cash in the phase of market uncertainty. We soon expect to see our customers trying to cannibalize existing equipment for capital components.”

In some instances, NOV has been considering customer requests for delivery delays to better help manage costs in the stretched supply chain. It’s happening to oilfield service providers everywhere, said Williams.

“Our customers are being very aggressive, and they seem to have the same form letter that they are sending to everyone…demanding very high discounts, double-digit percentage discounts. We are responding to those by sitting around the table with those customers by product line…and discussing ways that we can work together to mutually drive cost out of the system…I think by and large every business is handling it individually by customer.”

And the financial pressures don’t look to end soon. Unlike BP plc CEO Bob Dudley, who said Monday the oil price downturn was reminiscent of 1986, Williams said it’s more like 2002 or 2009’s downturn. During those two downturns, recovery “came within about two years,” he noted.

“We do not believe the global excess production capacity is excessive by historical standards,” Williams said. “We do not face the kind of structural global overhang the industry faced in 1986 when Saudi Arabian production had been pared down to that 4 million b/d of oil as global oil capacity exceeded 15% of demand…”

The recent swing source of incremental global oil supply “is coming from North American shales. The production type curve from these basins exhibit extraordinarily steep decline rates, which is well documented across thousands of wells in multiple share basins. New share reservoirs exhibit perhaps the highest natural decline rates for many major source of oil and the industries modern history.

“We see North American shale drilling slowing dramatically and [we’ve] quickly seen the rate of new shale wells coming online…decline, and 4 million b/d from U.S. shales will begin to decline steeply. We believe this could lead to modest oil price recoveries early in late 2015.

“However, we expect shale production to continue to grow to the first half of 2015 before it begins to fall, as the remaining inventory of wellbore is completed and brought online, which means recovery once it starts is maybe a slower drive, despite the steep decline curve behavior of shale oil.”

The oil industry has a “pretty good set of ingredients with which to make an oil price recovery scenario,” said Williams. “Nevertheless, we acknowledge many factors to keep oil prices down for longer: deteriorating global economic conditions, continued strengthening of U.S. dollar, and the return to the market of oil from sidelined countries are a few that come to mind…

“Given the speed at which we see drilling activities slowing, it is very difficult to for us to imagine that we are not see a significant oil supply response relatively soon. We don’t believe the world can sustainably grow its oil supply with prices below $80, $75/bbl, and with prices below $60, oil production will begin to contract.

NOV’s approach is to focus on what it can control, he said. The plan is to manage quarter to quarter “while we steadily reduce cost as utilization levels permit, while also continuing to advance the long-term strategic goals…”

Last year was a record one for shipping top drives, fiberglass pipe and jacking systems. Today, however, the company is working to keep its facilities better loaded.

“We’re examining opportunities to consolidate facilities where possible, and we are working with our suppliers to improve efficiencies and cost as our customers process for cost savings for their supply chains,” Williams said. “I’ll stress that these measures are not new to NOV nor are they new to the industry or to cyclical downturns. I might note this will be the sixth cyclical downturn we have faced through our carriers.”

Williams said that “sixth cyclical downturn has not dissuaded me from the basic pieces we outlined in November in line with ExxonMobil’s Outlook for Energy 2014 study [in December] that the world’s population will grow from seven billion to nine billion by the year 2040, economic growth will continue, standards of living will rise, oil and gas production will grow from a combination of shales and deepwater to fuel the world’s appetite for energy and a better life.

“Specifically, the Exxon [outlook] holds for 25% growth in oil and 65% growth in gas through the next 25 years. In the near-term, the E&P industry will sharpen its focus on improving economic efficiency and the marginal cost of production of oil.”

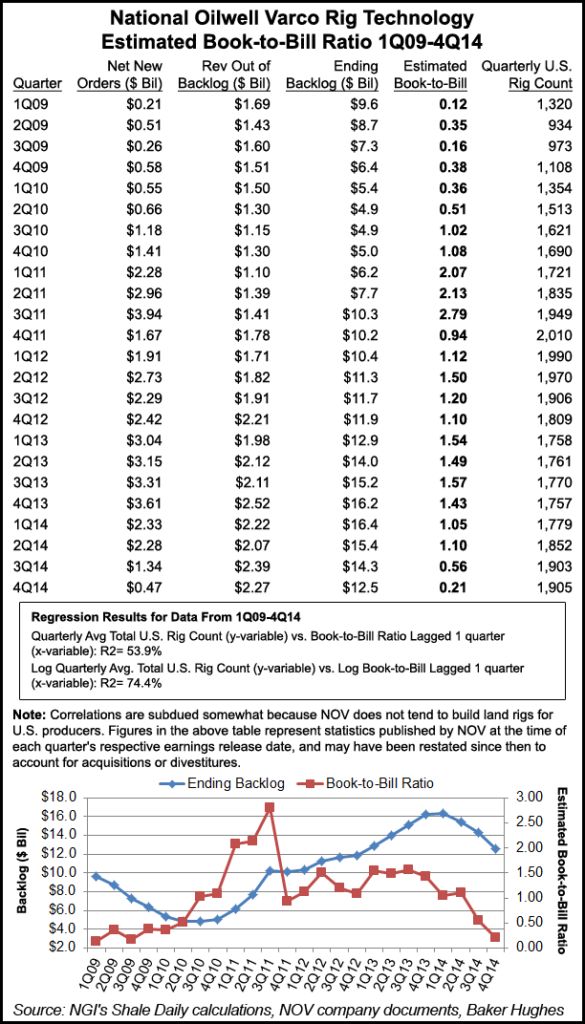

NOV’s net new orders for its Rig Systems segment in 4Q2014 totaled $470 million, down from year-ago orders of $3.61 biillion and $1.34 billion in 3Q2014. Net new orders also were higher in the first half of 2014, at $2.33 billion in 1Q2014 and $2.28 billion in 2Q2014. Rig systems revenue out of backlog in the final period of last year came in at $2.27 billion, down from $2.52 billion in the year-ago period and $2.39 billion sequentially.

The ending backlog for 2014 hit $12.5 billion, putting the estimated book-to-bill ratio for its rig systems segment at 0.21x, down from 1.43x in the year-ago quarter and 0.56x in 3Q2014.

NOV in the final quarter was “probably a little beyond our optimal kind of efficiency in terms of margin production in the backlog,” Williams said, “meaning we have more work and we were relying on graveyard shifts, and a lot of overtime, and kind of third, and fourth and five tier suppliers.

“I think there is some benefit actually as volume start to back off just a little bit, in terms of reducing some overtime of reverting to our…most productive suppliers to help in the margin front.” NOV also is in discussions with its suppliers about reducing the prices they charge. “We’re hesitant though to wrap margin improvement around that scenario because no doubt we’re going to continue to see price pressure and challenges that are coming out of the current slow market.”

Net income from continuing operations in 4Q2014 was $595 million ($1.39/share), versus year-ago profits of $627 million ($1.46). Excluding one-time charges, including on asset impairments, NOV earned $721 million ($1.69/share), up 13% year/year. Revenues rose 8% from a year ago, and operating profits jumped almost 18%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |