Utica Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Utica, SCOOP Keep Driving Production Gains for Gulfport

Strong core production from the Utica Shale and the South Central Oklahoma Oil Province (SCOOP) again helped Gulfport Energy Corp. increase volumes in the third quarter, even though it turned fewer wells to sales than analysts had expected.

Gulfport produced 1.428 Bcfe/d in the third quarter, up 19% from the year-ago period and 7% from 2Q2018. Despite ongoing activity in the SCOOP, the company’s production mix remained dry, with natural gas accounting for 89% of the quarter’s volumes.

“Gulfport’s third quarter production increase was driven by the continued outperformance of our base production wedge, an active turn-in-line schedule and an increase in ethane recovery during the quarter, maximizing the value received for the natural gas liquids stream,” said CEO Michael Moore.

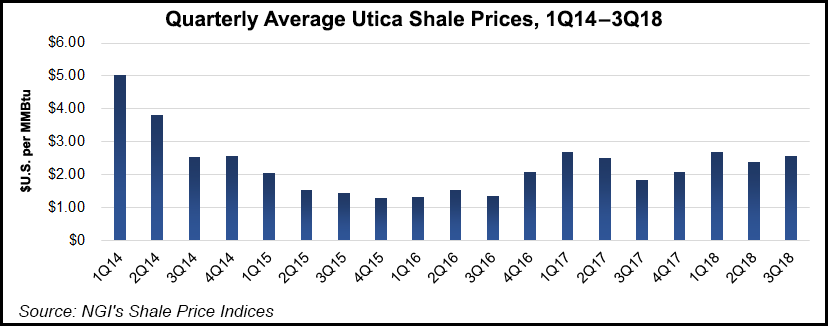

Average prices also were up during the quarter to $2.75/Mcfe, compared to $2.41/Mcfe in the year-ago period and $2.09/Mcfe in 2Q2018, when the company recorded a noncash derivatives loss of $76.8 million.

Moore said at the end of the second quarter that the company was beginning to benefit from various capacity additions in the Appalachian Basin that were helping to tighten basis in the Utica Shale, which continues to account for the bulk of the company’s production.

Realized natural gas prices before the impact of derivatives also improved to $2.32/Mcf during the third quarter. They were up from $2.28/Mcf in 3Q2017.

Gulfport turned-in-line 11 net wells in Ohio during the second quarter and another 5.4 net wells in the SCOOP.

Earlier this year, Gulfport raised the low-end of its annual production guidance to 1.32-1.34 Bcfe/d, instead of the previous range of 1.31-1.34 Bcfe/d. Williams Capital Group LP analyst Gabriele Sorbara said in a note to clients that given the company’s third quarter performance, he expects management to again raise full year guidance.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |