Shale Daily | Coronavirus | E&P | NGI All News Access

U.S. Upstream Facing ‘Serious’ Fallout as Markets Shudder, Crude Prices Plunge

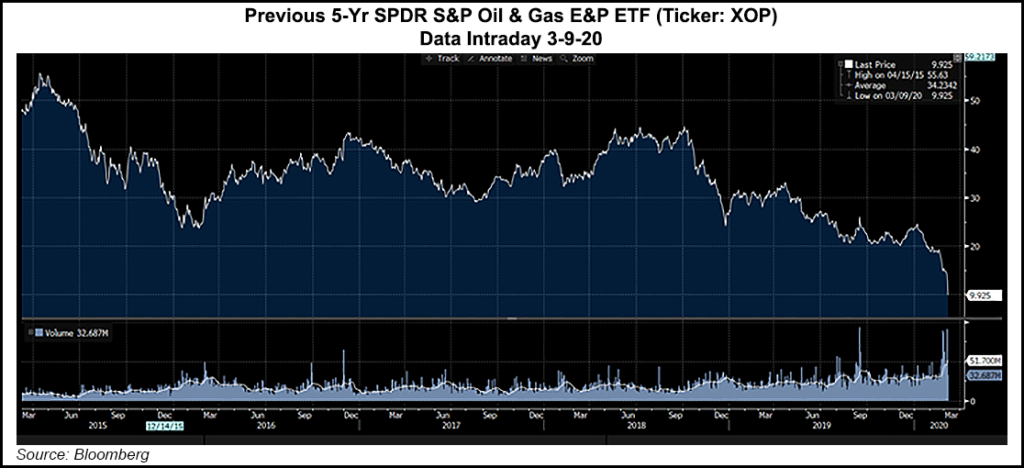

Investors fled stocks early Monday and crude prices plunged by double-digits as a price war between Russia and the Saudi-led oil cartel raged and the uncertainty of the coronavirus spooked global markets.

Crude prices fell by as much as 30% overnight Sunday, with West Texas Intermediate (WTI) wobbling down about 23% early Monday and Brent following in similar order. Global oil prices since the start of the year had lost more than half their value in early trading.

Global natural gas and oil demand has fallen sharply since the novel coronavirus, officially Covid-19, began to infiltrate the world beyond China. Although the World Health Organization had as of early Monday refrained, CNN on Monday said the escalation had reached pandemic levels.

The Saudi-led Organization of the Petroleum Exporting Countries (OPEC) last week recommended members and allies reduce oil output through the rest of the year, beyond a voluntary deadline of March 30, with additional reductions through June. However, ally Russia balked, leading Saudi Arabia Oil Co., aka Aramco, to cut prices and basically launch a price war.

Market reaction was devastating.

“The failed deal will have serious consequences for the U.S. upstream sector, with a significant decline in operators’ drilling and completions spend in 2020,” analysts with Tudor, Pickering, Holt & Co. (TPH) said Monday. Independent operators could reduce their 2020 spend by 25-30% if oil were to fall below $45/bbl, with “a meaningful deceleration of 2020-plus crude production growth.”

The “OPEC/Russia brinksmanship…has now devolved into a full-blown battle for crude oil market share, the reactions of the commodity, equity and debt markets are all saying loud and clear that no energy companies (or oil export-dependent countries) across the world or across the industry value chain will be immune from battle wounds,” said the TPH analysts.

Russia Energy Minister Alexander Novak said OPEC-plus would be free to produce “at will” beginning April 1, which could mean an oil price in the $20s “could be on the horizon,” the analysts said.

Analysts with BofA Global Research agreed that Brent and WTI oil prices could falter into the $20 range before long.

Brent is expected to “temporarily dip into the $20s range over the coming weeks,” the BofA analysts said. Analysts also reduced average Brent price forecasts to $45 from $54, with WTI falling to an average of $41 from $49.

The International Energy (IEA), already scheduled to issue its latest global oil market forecast, said unsurprisingly Monday demand is expected to decline this year because of Covid-19, with the impact “constricting travel and broader economic activity…

“The situation remains fluid, creating an extraordinary degree of uncertainty over what the full global impact of the virus will be,” IEA researchers said. In its central base case, demand this year is seen declining for the first time since 2009 because of the “deep contraction” in China’s oil demand, as well as major disruptions to global travel and trade.

“The coronavirus crisis is affecting a wide range of energy markets — including coal, gas and renewables — but its impact on oil markets is particularly severe because it is stopping people and goods from moving around, dealing a heavy blow to demand for transport fuels,” said IEA Executive Director Fatih Birol.

“This is especially true in China, the largest energy consumer in the world, which accounted for more than 80% of global oil demand growth last year. While the repercussions of the virus are spreading to other parts of the world, what happens in China will have major implications for global energy and oil markets.”

The IEA is forecasting global oil demand now to decline to 99.9 million b/d in 2020, down around 90,000 b/d from 2019. IEA in February had predicted global oil demand would grow by 825,000 b/d this year.

“The short-term outlook for the oil market will ultimately depend on how quickly governments move to contain the coronavirus outbreak, how successful their efforts are, and what lingering impact the global health crisis has on economic activity,” according to the global energy watchdog.

“The impact of the coronavirus on oil markets may be temporary,” Birol said. “But the longer-term challenges facing the world’s suppliers are not going to go away, especially those heavily dependent on oil and gas revenues. As the IEA has repeatedly said, these producer countries need more dynamic and diversified economies in order to navigate the multiple uncertainties that we see today.”

The Covid-19 “crisis is adding to the uncertainties the global oil industry faces as it contemplates new investments and business strategies,” Birol said. “The pressures on companies are changing. They need to show that they can deliver not just the energy that economies rely on, but also the emissions reductions that the world needs to help tackle our climate challenge.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |