E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Rig Count Unchanged as Pandemic-Induced Collapse Leveling Off

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |

Markets

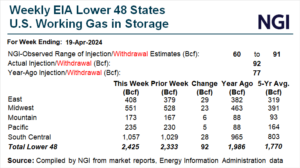

Weekly natural gas cash prices gained ground on the back of strong gains in West Texas in a week that was marked by stronger LNG feed gas flows and modestly higher weather-driven demand. NGI’s Weekly Spot Gas National Avg. for the April 22-26 trading period climbed 9.5 cents to $1.230/MMBtu. Among the top weekly gainers,…

April 26, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.