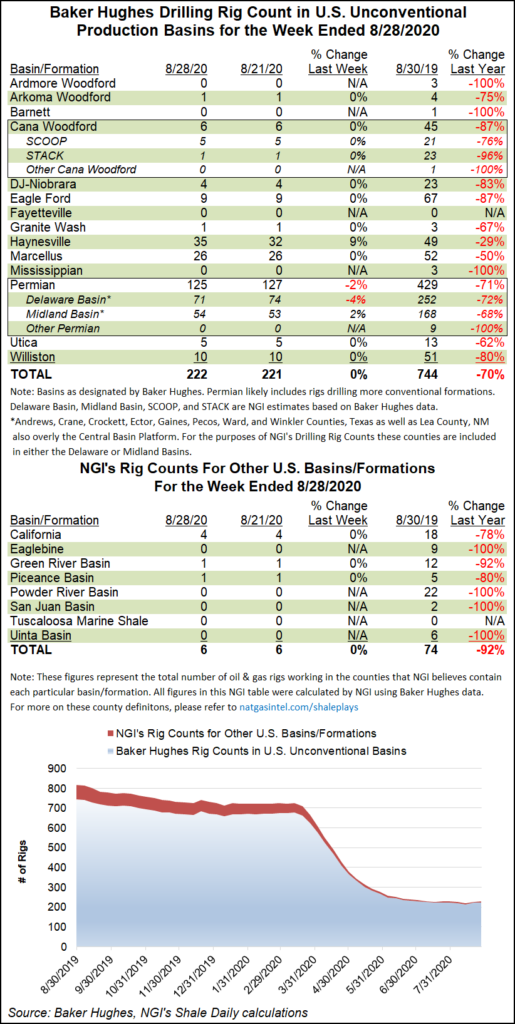

Gains in natural gas-directed drilling offset a drop in oil activity to leave the U.S. rig count unchanged at 254 during the week ended Friday (Aug. 28), according to the latest data from oilfield services provider Baker Hughes Co. (BKR).

The United States added three natural gas rigs and lost three oil rigs for the week, putting the combined domestic tally 650 units behind the 904 rigs active in the year-ago period. Land drilling and Gulf of Mexico activity were unchanged during the week, and the overall mix of directional, horizontal and vertical units was also unchanged, BKR data show.

The Canadian rig count fell two units — one oil-directed, one gas-directed — to end the week at 54, versus 150 at this time last year.

Listen to the latest episode of our newest...