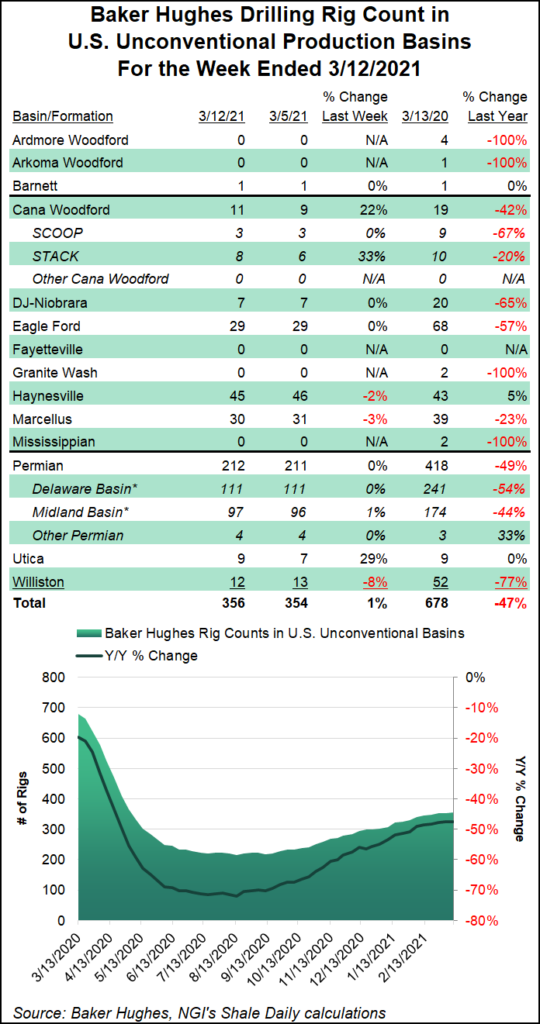

The U.S. rig count eased one unit lower to 402 for the week ending Friday (March 12) as increases in the Permian Basin and Utica Shale partially offset declines in the Marcellus and Haynesville shales, according to updated data from Baker Hughes Co. (BKR).

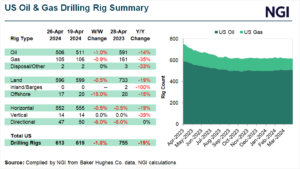

The total number of domestic natural gas-directed rigs remained unchanged at 92 for the week, with oil-directed rigs falling one unit to 309. The 402 combined active rigs in the United States as of Friday compares with 792 rigs running at this time last year, according to the BKR numbers, which are based partly on data provided by Enverus.

Land rigs remained unchanged overall week/week, while one rig exited in the Gulf of Mexico, dropping its total to 13, versus 19 a year ago. Horizontal and vertical rigs were unchanged, while...