The U.S. onshore drilling permit count bounced up during April, both month/month (m/m) and compared with a year earlier, with double-digit growth in many major plays.

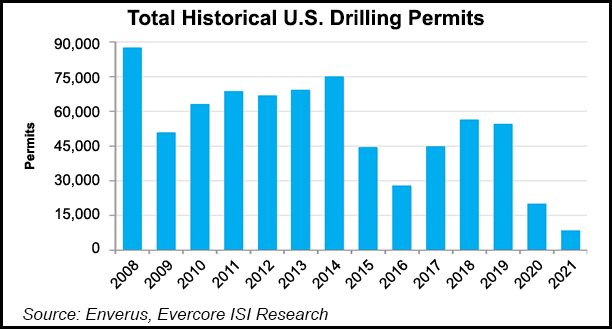

According to the monthly compilation by Evercore ISI, permitting in April jumped 19% from March and was up 13% from April 2020.

The Denver-Julesburg (DJ) Basin in Colorado “experienced a strong surge in permits, going to 117 from three in April,” said Evercore analysts led by James West. There also was “notable activity” in the Marcellus Shale, up 67% from March with a 62-permit gain.

“The Marcellus gets busy, thanks to a plethora of activity in Pennsylvania,” West said. “The state experienced its largest increase in the permit count m/m since 2018, rising to 130 permits (up 57 m/m). West...