NGI The Weekly Gas Market Report | E&P | Infrastructure | NGI All News Access

U.S. Natural Gas Rig Count Up Nine as Oil Drilling Retreats

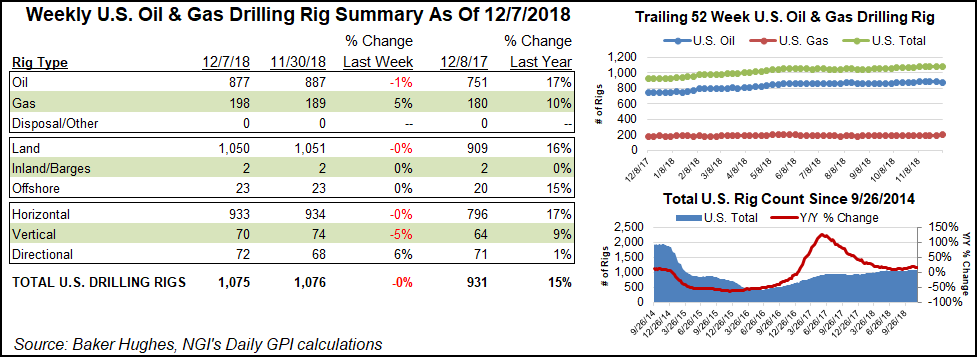

The U.S. natural gas patch added nine rigs for the week ended Friday (Dec. 7) even as oil-focused drilling pulled back sharply, according to data from Baker Hughes, a GE Company.

In the United States, 10 oil-directed rigs packed up for the week, offsetting the natural gas-focused gains to drop the domestic count one unit overall to 1,075 for the week. Total land units fell by one to 1,050, while Gulf of Mexico activity held flat at 23 active rigs. Four directional units were added, while four vertical units and one horizontal unit exited the patch, according to BHGE.

The Canadian rig count slid 13 to 186 as of Friday, down from 219 units a year ago, with 17 oil rigs packing up as four natural gas rigs returned to action. The combined North American rig count ended the week at 1,261, up from 1,150 in the year-ago period.

Among plays, the largest week/week (w/w) change occurred in the Permian Basin, where four rigs departed to drop the West Texas and southeastern New Mexico play to 489 active rigs, versus 400 a year ago. Meanwhile, the Cana Woodford grew its count by two to reach 57 rigs, lagging its year-ago total of 73.

Also among plays, the Eagle Ford and Marcellus shales each added one rig, while the Ardmore Woodford, Denver Julesburg-Niobrara, Haynesville Shale, Mississippian Lime and Utica Shale each dropped one rig.

Among states, Oklahoma posted the largest w/w decline, dropping three rigs to 142 (121 a year ago). Texas and Ohio each saw two rigs exit w/w, while Louisiana dropped one unit from its tally.

Also among states, New Mexico picked up two rigs w/w, while Alaska, Kansas, Pennsylvania, Utah and West Virginia added one rig each.

BHGE also released its international rig count for November on Friday, showing total active rigs outside of North America declining to 991, down sequentially versus 1,017 in October but up year/year from 942 counted in November 2017.

The North American rig count averaged 1,275 in November, up sequentially from 1,254 and year/year from 1,115, according to BHGE.

Recent disclosures from the oilfield services sector have hinted at a slowdown in activity for the North American onshore during the fourth quarter. Schlumberger Ltd. is signaling a sharper-than-expected sequential decline in profits for the fourth quarter because of a “significantly larger drop in activity” than expected, a top executive said Tuesday.

Executive Vice President Patrick Schorn, who oversees well activity, delivered the warning at Cowen & Co.’s 8th Annual Energy & Natural Resources Conference in New York City.

“So far in the fourth quarter, international revenue, excluding Cameron, is more or less in line with expectations, except for signs of weakness in a few countries in Latin America,” Schorn told the audience. In North America, the offshore business revenue and land drilling operations are trending to be flat from the third quarter.

However, for the North American fracturing business, a worse-than-anticipated decline in activity in the final three months of the year may lead to a sequential revenue decline for the region “in the range of 15%,” he said.

Meanwhile, sagging oil futures got a boost Friday as the Organization of the Petroleum Exporting Countries, aka OPEC, and its Russian-led allies on Friday agreed to further reduce global oil output in an attempt to balance an overflowing market and stem falling prices.

The Saudi-led cartel said production levels would be reduced by 1.2 million b/d beginning in January, despite pressure from President Trump to maintain current levels to benefit U.S. consumers at the fuel pump.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |