NGI All News Access | E&P | Infrastructure

U.S. Natural Gas Rig Count Down Four; Oil’s Dramatic Drop-Off Continues

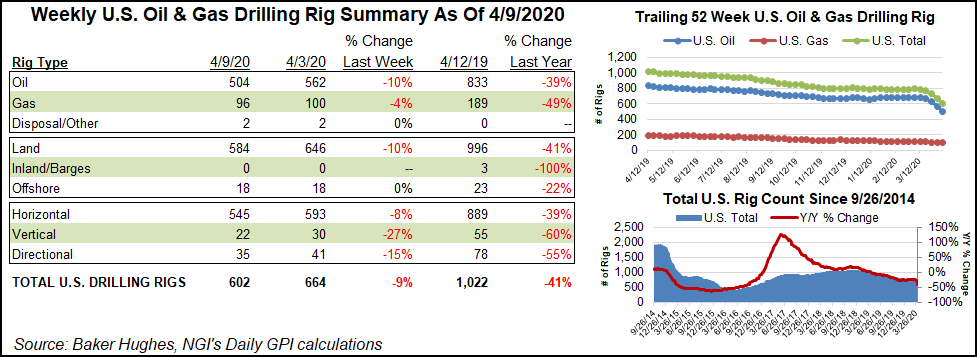

The U.S. natural gas rig count fell four units to 96 during the week ended Thursday (April 9) as a dramatic reduction in oil-directed activity sent the overall domestic tally plummeting once again, the latest figures from Baker Hughes Co. (BKR) show.

Responding to the global economic shocks of the Covid-19 pandemic and a collapse in crude markets, the U.S. patch as of Thursday had shed nearly 200 rigs since March 13. In the previous week BKR reported a 64-rig decrease, which followed a 44-rig drop reported the week before that.

For the most recent week, U.S. operators sent 58 oil-directed rigs packing, along with the four gas-directed units. That left the United States down more than 400 rigs from the 1,022 units active at this time last year.

All of the weekly declines occurred on land, with the Gulf of Mexico maintaining 18 rigs. Eight vertical units and six directional units joined 48 horizontal rigs in exiting for the week.

The Canadian rig count also declined week/week, dropping six rigs to end at 35, versus 66 in the year-ago period. The declines were split evenly between oil- and gas-directed rigs.

The combined North American rig count fell to 637 for the week, down from 1,088 at this time last year, according to BKR.

Among plays, the Permian Basin once again recorded the largest weekly drop-off, losing 35 rigs to fall to 316, well off of the 464 rigs running a year ago. The Eagle Ford Shale dropped six rigs week/week, while the Cana Woodford, Denver Julesburg-Niobrara and Williston Basin each dropped two rigs.

Also among plays, the Granite Wash and the Haynesville and Marcellus shales each dropped one rig on the week, while the Barnett Shale added one rig overall, according to BKR.

Among states, Texas unsurprisingly saw the largest weekly decline, falling 36 units to end at 302, precisely 200 units behind its year-ago tally. New Mexico saw seven rigs pack up during the week, Wyoming dropped four units and Oklahoma dropped three. Alaska, California, Colorado and Utah each dropped two rigs week/week, while Louisiana, North Dakota and West Virginia each dropped one.

Energy companies proved quick to take a red pen to their respective 2020 budgets in March as the coronavirus turned into a pandemic and the price war continued overseas, but some operators are finding they have to cut deeper in the face of uncertain demand for oil and gas.

For North American exploration and production (E&P) companies, a consensus appears to be building around average capital expenditure (capex) reductions of 35-40% from 2019, as Evercore ISI reported earlier this month.

In another calculation, IHS Herold said to date, North American E&Ps have slashed spend on average by 36%, translating to a $24.4 billion reduction. International oil companies have cut capex by 20-30%, with substantial reductions taken in U.S. operations.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |