E&P | Infrastructure | Marcellus | Markets | Natural Gas Prices | NGI All News Access | NGI The Weekly Gas Market Report | Uncategorized | Utica Shale

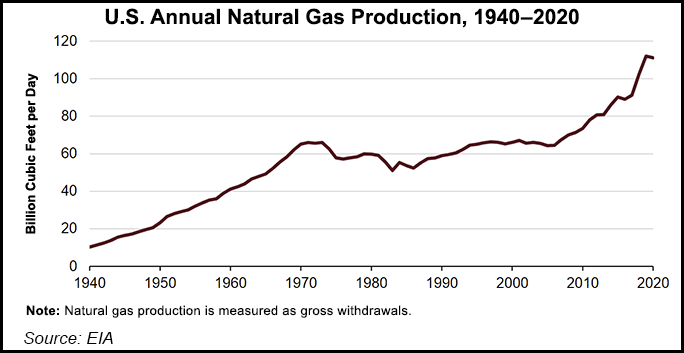

U.S. Natural Gas Production Fell 1% in 2020 Amid Pandemic, Lower Prices, EIA Says

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |