Natural gas and oil executives are likely to “prudently navigate” through turbulent commodity prices this year before sailing into smoother seas heading into 2025, according to industry analysts.

Exploration and production (E&P) companies in their quarterly conference calls, which are already underway, should be “guiding conservatively” in 2024, “particularly on the natural gas side,” Tudor, Pickering, Holt & Co. (TPH) analyst Matt Portillo said.

“In our view, 1Q2024/2024 outlooks will trump the 4Q2023 results,” Portillo said, “especially with the uncertainty around commodity prices and more stable service costs.” TPH is forecasting oilfield services costs to climb by 5% from 2023.

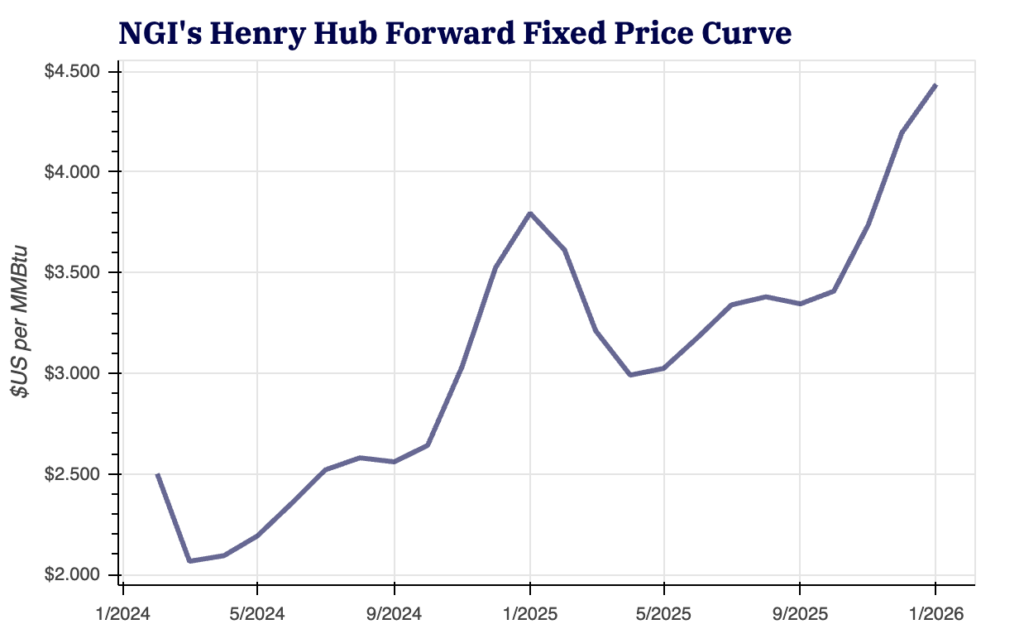

[Want to visualize Henry Hub, Houston...