Natural gas for delivery on Friday fell hard and often in Thursday’s physical trading as declines of over a quarter at Northeast points paced the trek lower. Futures bulls had to put up with a storage report showing a 74 Bcf build, just a couple of Bcf higher than expectations, but that was enough to put quotes in a free fall. At the close, June had fallen 16.8 cents to $4.572 and July was down 17.1 cents to $4.583. June crude oil skidded 51 cents to $100.26/bbl.

NGI Data

Articles from NGI Data

Futures Slip Ahead Of Fresh Storage Stats; Physical Natgas Trade is Mixed

Physical natural gas for Thursday delivery moved within a few pennies of unchanged at most points in Wednesday’s trading. Points in the Midwest, Midcontinent and Rockies were down from a couple of pennies to about a nickel, while the rest of the country was flat to higher, by approximately the same count.

Weather Seen Trumping Storage Refill; June Adds 11 Cents

Physical natural gas for Wednesday delivery fell nominally in Tuesday’s trading. Broad, though modest, gains in the Gulf Coast, California, and Great Lakes were unable to offset cascading quotes in the Northeast, Appalachia and Marcellus. Bigger picture, some storage operators expressed concerns regarding the rate of refill to date.

East Natural Gas Cash Strength Counters Weak Marcellus; Futures Inch Higher

Physical natural gas prices for Tuesday delivery gained ground in Monday’s trading with double-digit advances in the Northeast leading the pack higher. Those gains were able to offset declines in the Marcellus and flat trading at Midwest points. California locations also rose. At the close of futures trading June had risen 1.4 cents to $4.688 and July was higher by 1.1 cents to $4.715. June crude oil declined 28 cents to $99.48/bbl.

Northeast, California Lead End of Week Decline; Futures Ramble Lower

Physical gas for weekend and Monday delivery fell hard and fell often Friday as traders elected to not commit to gas they might very well have to turn back on Monday given the mild weather outlook.

Bulls, Bears Duel To A Tie; Week Ends With Both Still Standing

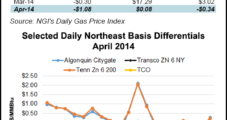

With the exception of the Northeast, all points were within a nickel of unchanged and the Northeast was only off a little over a dime for the week ended May 2. Buying for storage refill for the most part countered lessened weather load and the NGI Weekly Spot Gas Average nationally fell 3 cents to $4.64. Of the actively traded points Marcellus locations proved to be the week’s strongest gainers. Transco Leidy was up by 15 cents to $3.99 and Tennessee Zone 4 Marcellus added 14 cents to $3.95. Biggest losers proved to be Tennessee Zone 6 200 L dropping 28 cents to $4.39 and Tennessee Zone 4 313 Pool sliding 26 cents to $4.20.

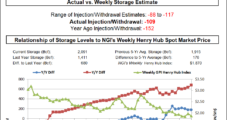

Bearish Build Sees Futures Retreat, But the Road to 3.5 Tcf Remains Long

Physical natural gas prices put in another mixed day Thursday as northeastern pricing points logged a third straight decline-day with temperatures expected to warm up a bit, while California and Rocky Mountain indexes firmed. June natural gas futures sank below $4.800 on bearish storage data to finish out Thursday’s regular session at $4.719, down 9.6 cents from Wednesday’s close.

Northeast Gas Prices Fall; Storage Refill Debate Continues

In mixed physical natural gas trading on Wednesday, a majority of pricing points gained or lost a couple of pennies to a nickel, except in the Northeast, where a number of points dropped by more than a dime, and Algonquin Citygate took a 30-plus-cent plunge. June natural gas futures traded within about a 10-cent range on the day, before closing out the regular session 1.6 cents lower than Tuesday’s finish at $4.815, as traders bided their time ahead of Thursday’s fresh dose of gas storage news.

Eastern Points Jockey For Position in New Pricing Paradigm; Futures Grind Higher

NGI spot natural gas prices overall were peppered with losses at eastern points in Tuesday’s trading for Wednesday delivery, but rising prices in the Gulf, California, the Midcontinent and Great Lakes lifted the overall market to a proximate 2-cent gain. Physical gas in the Northeast continues to re-align with the Henry Hub, but buyers in locations such as the Southeast are finding it difficult to parlay that re-alignment to their advantage.

Eastern Points Lead Broad Advance; Expiring May Vaults Higher

The spot natural gas market was hit with a double whammy in Monday’s trading as temperatures were forecast to drop to as much as 15 degrees below normal at major eastern points, and the expired May futures surged higher.