The third of four liquefied natural gas (LNG)-ready U.S. Jones Act tankers was christened earlier this month at New Orleans by Jacksonville, FL-based Crowley Maritime Corp. Louisiana, a 50,000 dead-weight-ton, 330,000-bbl capacity ship, joins Crowley’s sister LNG-ready vessels, Texas and Ohio, as the first tankers ever to receive the American Bureau of Shipping’s LNG-Ready Level 1 approval. As such, privately held Crowley, one of the largest independent U.S operators of petroleum barges and tankers, has the option of converting to LNG propulsion all three of the ships in the future. The new ships have advanced technologies providing fuel efficiency, flexible cargo capability and the meet latest regulatory requirements, a Crowley spokesperson said. The Philly Shipyard’s unit, PSI, built all three of the tankers. Separately, Crowley is involved in the development of the first of two new cargo ships destined for Mediterranean trade and outfitted with LNG engines (see Daily GPI, April 1).

Markets

Articles from Markets

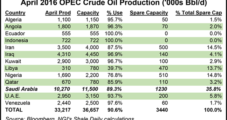

Long-Time Saudi Oil Chief Departs, But Energy Policy Said Unlikely to Change

Saudi Arabia on Saturday ousted longtime energy minister Ali Al-Naimi and promoted Khalid Al-Falih, who chairs the country’s national oil company, a move not expected to upend the country’s policy to allow markets — and not shut-ins — to rebalance prices.

NatGas Cash Easily Outdoes Softer Futures; June Essentially Flat

Physical natural gas for Tuesday delivery bounded higher Monday as traders noted a double-digit differential between the screen and Henry Hub quotes. Gains in California and the Rockies helped lift more sluggish points in the Midwest. The NGI National Spot Gas Average rose 15 cents to $1.88.

Briefs — Crowley Maritime Corp., Millennium Pipeline Co.

The third of four liquefied natural gas (LNG)-ready U.S. Jones Act tankers was christened earlier this month at New Orleans by Jacksonville, FL-based Crowley Maritime Corp. Louisiana, a 50,000 dead-weight-ton, 330,000-bbl capacity ship, joins Crowley’s sister LNG-ready vessels, Texas and Ohio, as the first tankers ever to receive the American Bureau of Shipping’s LNG-Ready Level 1 approval. As such, privately held Crowley, one of the largest independent U.S operators of petroleum barges and tankers, has the option of converting to LNG propulsion all three of the ships in the future. The new ships have advanced technologies providing fuel efficiency, flexible cargo capability and the meet latest regulatory requirements, a Crowley spokesperson said. The Philly Shipyard’s unit, PSI, built all three of the tankers. Separately, Crowley is involved in the development of the first of two new cargo ships destined for Mediterranean trade and outfitted with LNG engines (see Daily GPI, April 1).

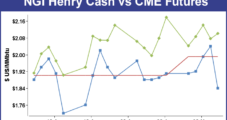

NatGas Cash Easily Outdoes Softer Futures; June Essentially Flat

Physical natural gas for Tuesday delivery bounded higher Monday as traders noted a double-digit differential between the screen and Henry Hub quotes. Gains in California and the Rockies helped lift more sluggish points in the Midwest. The NGI National Spot Gas Average rose 15 cents to $1.88.

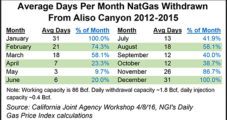

SoCalGas Storage Well Leak Costs Could Hit $665M; ‘Teachable Moment,’ Execs Say

In separate forums this week, senior executives of Sempra Energy and its Southern California Gas Co. (SoCalGas) utility began to deconstruct the unprecedented four-month natural gas storage well leak, which was sealed in mid-February, as underscoring the criticality of close electric-gas grid coordination and the heavily populated region’s energy reliability.

Weekly NatGas Cash Grinds Higher, But Futures Give Up 8 Cents

If futures remain true to their role as a leading indicator, natgas cash next week may have something of an uphill battle. That was not the case for the week ended May 6, however, as most points gained ground and the few that slipped into the loss column were mostly off by a penny or two.

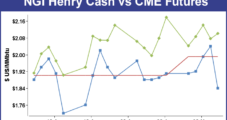

Futures Outperform Weak Weekend NatGas Cash; June Adds A Couple of Cents

Buyers of natural gas for weekend and Monday saw little reason to take action Friday and spot gas prices took a double-digit hit.

Weekly NatGas Cash Grinds Higher, But Futures Give Up 8 Cents

If futures remain true to their role as a leading indicator, natgas cash next week may have something of an uphill battle. That was not the case for the week ended May 6, however, as most points gained ground and the few that slipped into the loss column were mostly off by a penny or two.

Follow-Through Blues Frustrating Bulls; June Called 2 Cents Lower

June natural gas is set to open 2 cents lower Friday morning at $2.06 as traders assess the likelihood of increased, if not oversized, storage injections in the weeks to come. Overnight oil markets fell.