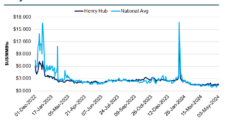

Natural gas futures forged ahead on Friday, building on the strong gains of the prior session as production held at lighter levels and forecasters continued to call for a hot summer ahead. At A Glance: Production below 99 Bcf/d Heat looms for late May Mixed views on inventories After gaining 10.3 cents on Thursday, the…

Markets

Articles from Markets

Natural Gas Rallies as Cheniere CEO Reassures Market on Maintenance — MidDay Market Snapshot

Natural gas futures were rallying through midday trading Friday after management comments from a major U.S. LNG player assuaged market concerns that maintenance disruptions could hamper summer export demand. Here’s the latest: June Nymex futures at $2.143/MMBtu, up 10.8 cents, as of 2:05 p.m. ET Cheniere Energy Corp. 1Q2024 results, management comments greeted enthusiastically by…

Natural Gas Futures Trade Both Sides of Even Early as Market Mulls Storage, Cooling Demand

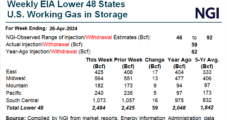

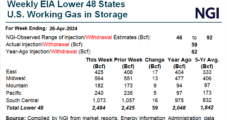

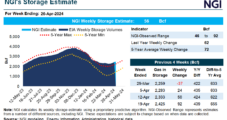

Natural gas futures were close to unchanged in early trading Friday as the market continued to mull plump storage inventories and potential cooling demand upside this summer. The June Nymex contract was off 0.8 cents to $2.027/MMBtu at around 8:45 a.m. ET. The U.S. Energy Information Administration (EIA) on Thursday reported a 59 Bcf injection…

Natural Gas Futures, Spot Prices Find Fresh Footing Following Seasonally Light Storage Increase

Natural gas futures on Thursday snapped a two-day losing streak, bolstered by a bullish storage print, lower production and forecasts for strong summer heat. At A Glance: EIA prints 59 Bcf injection Hotter temperatures ahead Output hovers at 97.6 Bcf/d The June Nymex gas futures contract rallied 10.3 cents day/day and settled at $2.035/MMBtu. After…

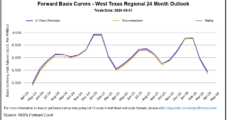

Natural Gas Forwards Slide as Pipe Maintenance Impacts West Texas Outlook

Amid continued downward pressure from excess storage inventories, and with cooling demand yet to ramp up in earnest, regional natural gas forwards drifted lower during the April 25-May 1 trading period, according to NGI’s Forward Look. June fixed prices at Henry Hub exited the period at $1.939/MMBtu, down 4.6 cents week/week. In line with the…

Natural Gas Futures Rally Back Above $2 as Freeport Flows Strengthen — MidDay Market Snapshot

Buoyed by higher volumes flowing to a major export terminal and continued production weakness, natural gas futures were rallying through midday trading Thursday. Here’s the latest: June Nymex futures up 10.4 cents to $2.036/MMBtu as of 2:25 p.m. ET, back in line with Monday’s close Production off to slow start for May, estimates show Wood…

June Natural Gas Futures Rally Above $2 Following Bullish Government Storage Print

The U.S. Energy Information Administration (EIA) on Thursday reported an injection of 59 Bcf natural gas into storage for the week ended April 26. The result came close to expectations but was notably below historical averages. The print reflected lighter production volumes and supported upward momentum for Nymex natural gas futures. Ahead of the 10:30…

As Market Prepares to Digest Storage Report, Natural Gas Futures Pare Losses Early

As traders prepared to digest a potential surplus-trimming result from the latest government inventory data, natural gas futures rebounded in early trading Thursday. The June Nymex contract was up 3.9 cents to $1.971/MMBtu as of 8:51 a.m. ET, clawing back a good chunk of the previous session’s 5.9-cent decline. Pre-report estimates were pointing to a…

Natural Gas Futures Slump Second Day Amid Elusive Demand, LNG Uncertainty; Cash Prices Fall

Natural gas futures extended losses on Wednesday as forecasts pointed to benign conditions and LNG demand proved soft, offsetting continued light production estimates and expectations for a seasonally bullish storage print. At A Glance: Unsupportive weather outlook Production hovers near 97 Bcf/d NGI models 56 Bcf storage build Coming off a 3.9-cent decline the prior…

May Bidweek Natural Gas Prices Slide as Storage Containment Worries Outmuscle Incoming Heat

Natural gas prices slipped lower in May bidweek trading as the month’s expected uptick in cooling demand was upstaged by hefty inventory levels and recent bumpy performances by Gulf Coast LNG terminals. NGI’s May Bidweek National Avg. fell 7.0 cents month/month to $1.240/MMBtu. Trading for the latest bidweek period spanned April 24, 25 and 26…