Energy Transfer Partners LP (ETP) and affiliate Regency Energy Partners LP on Monday agreed to merge in a transaction estimated to be worth $18 billion, creating one of the largest master limited partnerships (MLP) with operations in nearly all major producing areas of the United States.

M&A

Articles from M&A

Dominion Buying Carolina Gas Transmission

Dominion Resources Inc. is buying Carolina Gas Transmission (CGT) from SCANA Corp. for $492.9 million. CGT owns and operates nearly 1,500 miles of federally regulated interstate natural gas pipeline in South Carolina and southeastern Georgia.

Talisman Takeover Gives Repsol Big North American Footprint

Spain’s Repsol SA, which has been prowling for assets for the past three years to boost its flagging oil and gas reserves, on Tuesday agreed to buy Calgary’s Talisman Energy Inc., boosting output by 76% and establishing the operator as one of the top 15 producers in the world.

EOG Sells Canadian Assets, Keeps Acreage in $410M Deals

Houston-based EOG Resources Inc. on Monday announced the divestiture of all its assets in Manitoba and certain assets in Alberta in two separate confidential transactions that closed on Nov. 28 and Dec. 1. The move was mostly to shed natural gas assets.

UIL Abandons Deal to Buy Philadelphia Gas Works

UIL Holdings Corp. has terminated its $1.86 billion agreement to purchase Philadelphia Gas Works (PGW), the nation’s largest municipally-owned gas utility, after the city council’s decision in October to rule out what it deemed a risky sale.

Spending by Independents Drops in ’13 on Depressed NatGas Prices

Exploration and development (E&D) spending by independents worldwide dropped by 14% in 2013 from 2012 as depressed natural gas prices in North America took a toll on cash flows and spending ability, an annual survey by EY found.

Less Appetite for Whipping Up E&P Deals in 2015, Say Execs

The global economy may be increasingly stable, with resilient equity markets, but the global oil and gas landscape for mergers and acquisitions (M&A) is only cautiously optimistic, according to EY’s 11th biannual Oil and Gas Capital Confidence Barometer.

Quanta Expands Into Canada After Acquiring Banister

Quanta Services Inc. announced Monday that it had acquired Banister Pipelines Corp., a move that will expand the Houston-based company’s pipeline construction and maintenance business in Canada.

Texas Still Tops For Global Natural Gas, Oil Investment, Says Survey

Texas remains the most attractive place in the world for oil and natural gas investment, with Alberta holding the No. 2 position, the Fraser Institute reported Thursday.

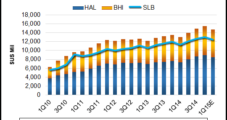

Halliburton in Merger Talks with Baker Hughes

Baker Hughes Inc. affirmed it is in preliminary discussions with Halliburton Co. regarding a potential merger, a blockbuster prospect for North America’s onshore and offshore operators — and for Houston as well, where the oilfield giants are headquartered.