NO. 1: Feed gas deliveries to U.S. LNG export plants ticked back up on Thursday after recent downturns as maintenance season gets underway. Overall, U.S. feed gas demand was nominated at 10.8 Bcf, up 5% from Wednesday. Nominations for the Freeport liquefied natural gas export terminal in Texas on Thursday were at 276 MMcf, or…

LNG

Articles from LNG

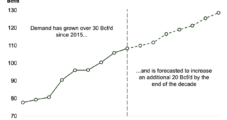

From LNG to Data Centers, Kinder Morgan Bullish on Natural Gas Growth

Producers of natural gas may be struggling with low prices, but for pipeline operators like Kinder Morgan Inc. (KMI), the outlook is anything but bearish. The Houston-based midstreamer, which transports about 40% of the natural gas consumed in the United States, kicked off the first quarter earnings season with stellar results and a positive message…

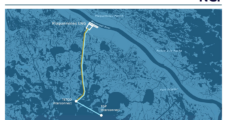

Portion of Plaquemines LNG’s 2 Bcf/d Pipeline Project Ready for Service, Venture Global Says

The chances of feed gas being introduced to Venture Global LNG Inc.’s Plaquemines LNG project by the end of the year could be rising as the firm awaits approval to place a portion of its pipeline in service. Venture Global asked FERC to allow it to begin introducing natural gas to the 11.7-mile, 42-inch diameter…

Canadian Natural Gas Production Holds Strong, on Track for Record Year Despite Price Weakness

Natural gas production held near all-time highs through the first quarter in Canada, even as prices slumped following a mild winter that left supplies in storage at robust levels. That’s because producers are looking beyond near-term weakness and toward an anticipated jump in export demand, according to analysts. LNG Canada is slated to begin operations…

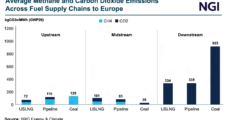

Industry Rails Against Biden LNG Pause With Research on Environmental Advantages

U.S. natural gas trade groups this week unveiled a study to demonstrate that American LNG is mostly better for the environment than competing fossil fuels in overseas markets as they continue to push back against the Biden administration’s pause on export project authorizations. “American natural gas is not only critical to our economy, but it…

Freeport LNG’s Extended Drop in Feed Gas Adds Pressure to U.S. Natural Gas Demand

Flows of natural gas to Freeport LNG have remained at a trickle for a week, fueling market concern that possibly all three trains at the facility could be offline after a reported issue with Train 3 last week. Nominations for natural gas to the liquefied natural gas facility had been reduced to about one-fourth of…

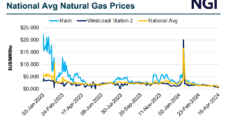

Natural Gas Futures Return Gains as TC Energy Isolates NGTL Rupture in Western Canada

Natural gas futures declined in early trading Wednesday, giving back the gains recorded after an incident on the Nova Gas Transmission Ltd. (NGTL) in Alberta rattled markets and briefly sent prices soaring. The May Nymex contract was down 5.5 cents to $1.677/MMBtu at around 8:40 a.m. ET. Operator TC Energy Corp. on Tuesday said it…

Pieridae Seeks to Transfer Goldboro LNG Approvals to Irish Buyer

Pieridae Energy Ltd. could be looking to sell its abandoned Goldboro LNG project in Nova Scotia to an Irish energy firm, according to a recently published regulatory filing. Calgary-based Pieridae asked Nova Scotia’s utility and review board for permission to transfer its approvals for the potentially 1.3 Bcf/d export project to Simply Blue Group, a…

Equinor Bets On Electrification to Sustainably Extend Natural Gas Supply to Europe

Equinor ASA is phasing out gas-fired generation in one of its most prolific natural gas production hubs in favor of electricity as it looks to increase both the sustainability and the lifespan of its North Sea operations. Norway’s Equinor disclosed that its offshore facilities at the Sleipner field and the adjacent Gudrun platform had been…

Natural Gas Futures Steady Early as Market Mulls Sagging Production, LNG Numbers

After tumbling in the previous session, natural gas futures held steady in early trading Tuesday as the market continued to assess apparent weakness in both export and production volumes. The May Nymex contract was trading fractionally lower at $1.690/MMBtu at around 8:45 a.m. ET. The latest daily production estimates from Wood Mackenzie showed domestic output…