With strong performance in both the Fayetteville and Marcellus shales, Houston-based Southwestern Energy Co. set a number of records during the first quarter.

NYMEX

Articles from NYMEX

Industry Brief

Encana Corp. on Monday agreed to pay a $5 million fine and pleaded no contest to charges that it attempted to commit antitrust violations in connection with a 2010 oil and gas lease sale in Michigan. Chesapeake Energy Corp. indicated that it plans to continue to fight the charges. Both companies were formally charged in March by Michigan officials for allegedly collaborating in 2010 to avoid bidding against each other in a lease sale (see Daily GPI,March 6). The U.S. Department of Justice, which had been conducting a parallel investigation, has dropped its charges against both companies (see Daily GPI,May 1).

Industry Brief

LyondellBasell has received a key permit required in the company’s multi-plant ethylene expansion program, which when fully operational is expected to increase annual ethylene capacity by 1.85 billion pounds per day, for a total estimated capacity of 11.8 billion pounds per day in North America. The ethylene expansion program began in 2013 and represents a total investment of approximately $1.3 billion in the company’s Texas plants in Channelview, La Porte and Corpus Christi, which benefit from shale gas production. The U.S. Environmental Protection Agency (EPA) recently issued a final greenhouse gas permit for the Corpus Christi project. The permit is the first to be drafted by the Texas Commission on Environmental Quality and issued by EPA under a new program designed to help improve permitting efficiency and productivity for applicants in Texas. The multi-plant ethylene expansion is expected to be fully operational by the end of 2015 (see Daily GPI,Jan. 3).

Industry Briefs

Atlas Pipeline Partners LP (APL) has brought online its Stonewall cryogenic gas processing plant in the Arkoma section of the Woodford Shale, which will add capacity to APL’s SouthOK system. The partnership is also accelerating plans to potentially increase the capacity at Stonewall, given increasing activity by Arkoma Basin and South Central Oklahoma Oil Province producers (see Shale Daily,May 1). Stonewall has an initial capacity of 120 MMcf/d. The plant was constructed under the Centrahoma joint venture with MarkWest Energy Partners, in which APL owns 60%. Due to the increase in activity in southern Oklahoma, the APL plans to accelerate the planned 80 MMcf/d expansion of Stonewall, bringing capacity to 200 MMcf/d. The expansion will add refrigeration and compression at the plant and will result in total gross processing capacity of 580 MMcf/d on the partnership’s SouthOK system.

Northeast, California Lead End of Week Decline; Futures Ramble Lower

Physical gas for weekend and Monday delivery fell hard and fell often Friday as traders elected to not commit to gas they might very well have to turn back on Monday given the mild weather outlook.

Bulls, Bears Duel To A Tie; Week Ends With Both Still Standing

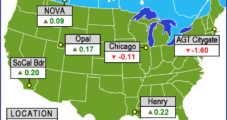

With the exception of the Northeast, all points were within a nickel of unchanged and the Northeast was only off a little over a dime for the week ended May 2. Buying for storage refill for the most part countered lessened weather load and the NGI Weekly Spot Gas Average nationally fell 3 cents to $4.64. Of the actively traded points Marcellus locations proved to be the week’s strongest gainers. Transco Leidy was up by 15 cents to $3.99 and Tennessee Zone 4 Marcellus added 14 cents to $3.95. Biggest losers proved to be Tennessee Zone 6 200 L dropping 28 cents to $4.39 and Tennessee Zone 4 313 Pool sliding 26 cents to $4.20.

Industry Briefs

Regency Energy Partners LPplans to add a 200 MMcf/d cryogenic processing plant and natural gas liquids (NGL) pipeline at its Dubberly facility in North Louisiana that would accept gas from Regency’s recently completed Dubberly gathering trunkline. The residue outlet for the facility would be the Regency Intrastate Gas System. A 160-mile, eight- and 10-inch diameter NGL pipeline would run from Dubberly to fractionation facilities with initial capacity of 25,000 b/d and expandable via additional pump stations. The projects are expected to cost $260 million and be completed by mid-2015. “Strong drilling around our facilities in the richer Cotton Valley play is driving significant volume growth,” said Regency Chief Commercial Officer Jim Holotik. “This expansion will allow us to provide incremental processing solutions and create an alternative outlet for newly-produced NGLs from the region.”

Industry Brief

An Anadarko Petroleum Corp. subsidiary has sold its San Juan Plant, a natural gas processing facility in Kirtland, NM, to Castleton Commodities International LLC (CCI) for an undisclosed amount. The purchase includes about 225 miles of gathering pipelines, 150 of which connect into CCI’s existing Lisbon plant. The plant has a capacity of 75 MMcf/d and can recover liquids through a 20 MMcf/d cryogenic unit. The transaction expands the commodities merchant’s footprint in the Four Corners area. CCI, which also has upstream and midstream properties in Colorado and Utah, markets physical commodities that include gas, liquids and refined products, as well as power.

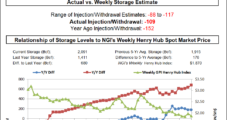

Bearish Build Sees Futures Retreat, But the Road to 3.5 Tcf Remains Long

Physical natural gas prices put in another mixed day Thursday as northeastern pricing points logged a third straight decline-day with temperatures expected to warm up a bit, while California and Rocky Mountain indexes firmed. June natural gas futures sank below $4.800 on bearish storage data to finish out Thursday’s regular session at $4.719, down 9.6 cents from Wednesday’s close.

Bidweek Finds Marketers Locking In May; Utilities Refilling Storage

For utilities and those with storage facilities severely depleted by the ravages of a vortex-driven winter, May indices offered the opportunity to refill at what could be a relative bargain. Despite large declines in the Northeast and Midwest,NGI’sMay National Bidweek Average rose a nickel over April to a modest $4.48. Individual market points in the East fell the most with Algonquin Citygate dropping $1.60 to average $4.60 and Tennessee Zone 6 200 L dropping $1.56 to $4.70. Marcellus Shale pricing points, with their unique abundance of supply and capacity constraint issues, rose the most with Transco-Leidy Line gaining 64 cents to $3.44 and Tennessee Zone 4 Marcellus rising 79 cents to $3.42.