Switching roles from Tuesday’s trade when Northeastern physical natural gas prices climbed while the rest of the country sank, much of the nation’s pricing points Wednesday for Thursday delivery saw small upticks, while prices in the East and Northeast declined — all while a winter storm moved up the eastern seaboard.

Tag / natural gas

Subscribenatural gas

Articles from natural gas

Colorado Lawmakers Propose Mineral Rights Royalty Bills

Two Colorado state lawmakers have proposed separate bills to force local governments that impose drilling bans to pay mineral rights owners for their lost royalties.

BHP Cuts U.S. Drilling Program, to Focus on Liquids

In response to weak commodity prices Australia’s BHP Billiton Ltd. is dialing back operations in U.S. shale plays, with plans to cut its operated rig count to 16 from 26 by the end of June, a nearly 40% reduction.

Industry Brief

Noble Energy Inc. said an exploratory well drilled in the offshore Gulf of Mexico did not encounter commercial hydrocarbons. The company said the Madison well, which targeted the Upper and Middle Miocene formations, was drilled to a total depth of 16,859 feet from Mississippi Canyon Block 479. The well has since been plugged and abandoned, and the drilling rig released. Noble operated the well and had a 60% working interest (WI), while Stone Energy Offshore LLC held the remaining 40% WI.

Northeast Gains Amid Sea of Red Ink; Futures Spiral Lower

Next-day gas prices Tuesday in the Northeast generally took their cue from near-term weather forecasts and a firm power market, but market centers and producing zones more in alignment with the Henry Hub followed the free-falling futures market and shed more than a dime. The overall market loss was 15 cents.

People

Stephen Rineyhas been tapped byApache Corp.as executive vice president and CFO effective in February. He most recently served as CFO forBP plc’s exploration production business, where he oversaw all accounting, business development, planning and commercial operations for the upstream segment. He previously had spent nine years withAmoco, which merged with BP in 1998. Riney holds an undergraduate degree from the University of Notre Dame and a master’s degree from the University of Chicago.John J. Christmann IV, formerly COO of North America operations, has assumed the role of president and CEO following the retirement ofG. Steven Farris, 66, who had been CEO since 2002 and chairman since 2009 (seeDaily GPI,Jan. 20).

Industry Briefs

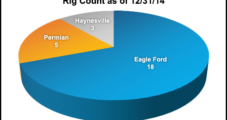

Comstock Resources Inc.said 2014 proved oil and natural gas reserves increased year/year to 620.4 Bcfe from 585 Bcfe, which included 495 Bcf and 20.9 million bbl, 68% proved developed. The present value of the reserves, using a 10% discount or PV-10, was $1.1 billion, using average 2014 prices of $3.96/Mcf and $92.55/bbl. The Frisco, TX-based independent’s output in 2014 averaged 180 MMcfe/d. Oil production comprised 39% of total output, versus 20% in 2013. Oil production rose 86% year/year to 4.3 million bbl; gas output fell 29% to 39.8 Bcfe. The Eagle Ford Shale contributed 5.1 million bbl and 5 Bcf, or 5.9 million boe to reserves. The Haynesville Shale and other regions added 74 Bcf in 2014. Finding costs for 2014 were estimated at $28.75/boe. Comstock has restarted Haynesville development in response to low oil prices (seeShale Daily,Dec. 18, 2014).

Northeast NatGas Basis Skyrockets; Traders Differ on Why

Natural gas forwards markets in the U.S. Northeast were revived this week, with prompt-month basis prices at the volatile New England hub surging more than $2 on a host of factors, including one that a regional trader said had nothing to do with fundamentals.

Industry Briefs

Louisiana’s Port of Lake Charles and the Panama Canal Authority have agreed to cooperate on marketing and other initiatives to attract liquefied natural gas (LNG) business. The canal is being expanded to accommodate the wider beams of LNG carriers; the canal is currently too narrow to allow their transit. The canal authority recently announced the rates it plans to charge LNG carriers as well as other shippers using the canal (see Daily GPI,Jan. 9). According to the canal authority, its agreement with the Port of Lake Charles will promote cooperation in marketing activities, information exchange, market research, training and technology, as well as other initiatives.

Northeast Leads Broad Retreat; Futures Holding $3

There was little interest Friday in committing to weekend and Monday deals, and prices fell hard and fell often.