March Bidweek prices were all over the map, with multi-dollar gains posted in the Midwest and multi-dollar losses seen in the Northeast. TheNGI March Bidweek national average was $5.84, down 74 cents from February, but tell that to buyers on the AlgonquinCitygates, who paid the month’s highest index at $15.52, down $19.98, or on Tennessee Zone 6 200 L where the March Index was $14.63, down $11.93. Lowest bidweek prices were seen on Transco Leidy, which was $1.91, down $1.43 from February, and Tennessee Zone 4 Marcellus, which was $1.93, down $1.47.

Tag / natural gas

Subscribenatural gas

Articles from natural gas

Appeals Court Sides With Dominion on Cove Point Exports

The Maryland Court of Special Appeals last Friday handed backers of the Dominion Cove Point liquefied natural gas (LNG) export project another victory in their battle with environmentalists.

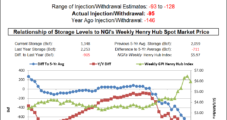

EIA: Natural Gas Storage Capacity Increased 2% in 2013

The U.S. Energy Information Administration (EIA) said underground natural gas storage capacity in the Lower 48 states grew 2% in 2013, due in large part to storage gains through salt domes in the Producing region and depleted wells in the West, but there was almost no growth in storage capacity in the East.

Midwest, East Lead Quotes Higher; Futures Struggle

Physical natural gas for Tuesday delivery moved abruptly higher in Monday’s trading. A storm ripping across the Mid-Atlantic sent prices in some areas to double-digit dollar gains, but quotes all along the Eastern Seaboard were mostly solidly in the black.

Midwest Prices Skyrocket as Buyers Stock Up for Weekend

Spot prices for gas for delivery for the weekend and Monday vaulted higher Friday, led by gains in the Midwest and Great Lakes. Buyers were scrambling for supplies as weather-driven prices on pipelines serving the frozen tundra of Minnesota, Wisconsin and Michigan posted double-digit dollar gains.

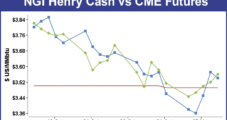

Weekly Traders Hit Hard With Futures, Physical Price Volatility

It was a week of gut-wrenching price changes for both futures and physical natural gas traders. The March futures contract expired Wednesday at a “reasonable” $4.855, but just two days prior, it had traded as high as $6.493 before falling into a tailspin and losing 69.0 cents on the day and finishing at $5.445 Monday. Tuesday’s and Wednesday’s trading added cumulative losses of another 59.0 cents — a 21% drop over three days — and any March futures bulls left standing limped off into the cold and snow to shore up margin accounts.

People

Bill Klesse will step down as CEO of Valero Energy Corp. May 1, but will remain a director and chairman of the board, the San Antonio-based company said. Klesse, who has spent his entire 45-year career with Valero and its predecessor companies, became CEO in 2005 and was named chairman of the board in 2007. Joe Gorder, who was elected president and COO in 2012, will become CEO effective May 1. He was immediately elected to the board of directors. During his 27 years with Valero, Gorder has held positions including executive vice president, chief commercial officer and president of Valero Europe; executive vice president-Marketing and Supply; and senior vice president for Corporate Development and Strategic Planning.

Industry Briefs

Lucid Energy Group LLChas finalized a $200 million revolving credit facility that will support growth in the Permian Basin. Together with private equity commitments from EnCap Flatrock Midstream and management, the credit facility provides Lucid with $425 million in available financing. Lucid increased its capital sources to support expansion of its pipeline gathering system and natural gas processing facilities in West Texas, which serve production from the Midland Basin’s Wolfcamp and Cline shales. Lucid’s system includes more than 300 miles of high- and low-pressure pipeline delivering liquids-rich natural gas to two separate cryogenic processing complexes in Sterling and Irion counties. The company has commissioned a third cryogenic processing plant and a nitrogen rejection plant in Sterling County. The new plant will bring Lucid’s processing capacity to 120 MMcf/d. Acreage dedications to Lucid exceed 800,000 acres across an eight-county area of the Midland Basin and include Wolfcamp Shale production centered in Irion, Reagan and Crockett counties and Cline Shale production centered in Sterling County.

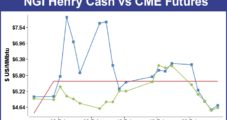

Traders Unfazed by Bearish Storage Stats

Physical natural gas prices for Friday delivery were broadly mixed in Thursday trading, with gains posted in New England, California and the Rockies and declines seen in the Midwest, East and Gulf.

Traders Exiting March Positions As Frigid Weather Remains In Play

The expiring March futures are expected to open 26 cents lower Wednesday morning at $4.840 as traders continue to unwind positions and anticipate less volatile trading in the April contract. Overnight oil markets inched higher.