A township in southeast Pennsylvania has vowed to keep fighting Sunoco Logistics Partners LP’s Mariner East pipeline even if the state Public Utilities Commission (PUC) grants it the status of a public utility corporation, which would exempt it from local zoning ordinances.

Tag / natural gas

Subscribenatural gas

Articles from natural gas

Shales Stepping Up to U.S. Energy Demand Challenge, EIA Finds

The United States has been burning more natural gas this year and relying less on imported energy overall, according to the U.S. Energy Information Administration (EIA), which credited the Bakken, Marcellus and Eagle Ford shales as well as the Permian Basin for increased liquids production.

Correction

In the Oct. 9 article WPX Still appealing PA orders to Replace Families’ Water Supplies (see Shale Daily,Oct. 9) NGI’s Shale Daily incorrectly reported the kind of impoundment the company operated in Westmoreland County, PA. That impoundment once held freshwater and treated water, and has since been reclaimed. NGI regrets the error.

Industry Brief

NuDevco Midstream Development LLC, sponsor of Marlin Midstream Partners LP, said it has bought land in Eunice, NM, to develop a crude oil terminalling site. Financial terms were not disclosed. The land includes rail spurs and truck siting, and the site is being configured to accommodate additional rail space and tank storage. Located in Lea County, NM, the site targets the western Permian Basin, which encompasses the western part of Texas and the southeastern part of New Mexico. NuDevco has continued to purchase assets in the crude oil value chain, including rail cars, crude oil trucks, stabilizer tower units, and storage tanks, the company said. NuDevco CEO W. Keith Maxwell said assets to be developed at the site would be potentially dropped down to Marlin Midstream. Last year the company announced the acquisition of a 28-acre site near Albuquerque, NM (see Shale Daily,Aug. 27, 2013).

Eastern Points Flirt With New Lows; Futures Inch Higher

Physical natural gas for weekend and Monday delivery fell hard in Friday’s trading as increased supplies, mild temperatures and load-killing rain over the weekend in eastern markets were expected to give way to seasonal readings by Monday.

Weekly Natgas Trading Sees Weak Futures Eclipsed By A Weaker Cash Market

Low power loads, weak power pricing, and moderate seasonal shoulder season weather all were on duty to send weekly natural gas prices scurrying lower. TheNGI Weekly National Spot Gas Price Average tumbled 30 cents to $3.41, and of all market points followed by NGI, only 3 made it to the plus column.

People

Helge Lund, 51, who helmed Norway’s state-owned Statoil ASA for a decade, will take over BG Group plc in March. BG, UK’s third largest producer, was led by more than a 10 years by Frank Chapman until he retired in 2012 (see Daily GPI,Dec. 14, 2012). Chapman’s successor Chris Finlayson left in March. “Helge is ideally suited to lead BG Group in the next phase of its growth,” said BG Chairman Andrew Gould. “Helge’s track record speaks for itself. He has built a world-class exploration and production portfolio at Statoil.” BG is one of the world’s largest liquefied natural gas traders, and is involved in export projects on the U.S. Gulf Coast and in British Columbia (see Daily GPI,April 4;March 26). BG also has U.S. onshore holdings, including in the gassy Haynesville Shale (see Daily GPI,June 17). Statoil marketing chief Eldar Saetre was appointed interim CEO following Lund’s departure.

Industry Briefs

Gas Natural Inc.subsidiary Energy West Inc. has agreed to sell Wyoming natural gas utility assets, Energy West Wyoming Inc., to Black Hills Corp. for $17 million. The parties said they plan a smooth transition for customers. The transaction is expected to close within a year. Energy West intends to use the proceeds to reinvest in the business. In 2Q2014, Gas Natural reported a $1.4 million loss (minus 14 cents/share), compared with a loss of $300,000 (minus 4 cents) in 2Q2013.

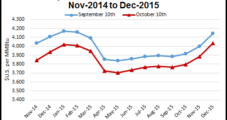

NGI’s Forward Look Paints a Bearish Portrait of 2015 NatGas Pricing

With winter 2014-2015 right around the corner, many in the natural gas market seem relatively comfortable with their fourth quarter price expectations now that worries about insufficient winter supply have been mostly assuaged by an exceedingly strong storage injection season. Looking to get a handle on how 2015 might play out, there is no shortage of factors at play.

Industry Brief

Recently released disclosures from the Pennsylvania Emergency Management Agency (PEMA) show dozens of trains carry millions of gallons of mostly Bakken and Canadian crude oil through the state each week toward refineries on the East Coast. PEMA was ordered to release the documents by the Pennsylvania Office of Open Records after it found the information included in them was not confidential or proprietary (see Shale Daily,Oct. 6). The state’s leading rail companies, Norfolk Southern Railway Co. and CSX Transportation Inc., run a combined total of up to 75 crude trains through Pennsylvania each week, which comes as no surprise given the visibility of the marked tanker cars running through cities such as Pittsburgh as they enter the western part of the state heading east. The reports show that the trains carry a minimum of one million gallons of crude oil each.