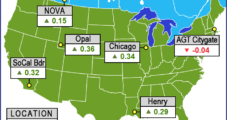

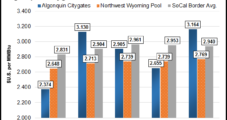

Bidweek sellers for June enjoyed hefty gains of a quarter or more as a broad rally encompassed all sections of the country with all but a handful of points enjoying stout double-digit gains. The NGI June Bidweek National Average surged 26 cents to $2.55, and no actively traded points suffered declines.

Tag / natural gas prices

Subscribenatural gas prices

Articles from natural gas prices

People

Pacific Gas and Electric Co. (PG&E) President Christopher Johns, 54, said he plans to retire at the end of this year, and PG&E CEO Tony Earley said the company’s board is expected to approve Johns’ replacement before the retirement is effective. Johns joined PG&E in 1996 as vice president and controller, following a career as a certified public accountant at KPMG Peat Marwick LLP where he was a partner. He was named PG&E CFO in 2005 and became the utility president in 2009.

Industry Brief

Petroleos Mexicanos (Pemex) and BlackRock have signed a memorandum of understanding (MOU) to accelerate financing of energy-related infrastructure projects. BlackRock will provide industry expertise, risk management capabilities and sources of financing to Pemex. “We believe that Mexican infrastructure presents a substantial investment opportunity for our clients and builds on BlackRock’s long-standing presence in Mexico while demonstrating the firm’s ongoing commitment to the region,” said Armando Senra, BlackRock head of Latin America and Iberia. In March, BlackRock and First Reserve agreed to take a 45% stake in the phase two segments of Pemex’s Los Ramones Pipeline Project. The pipelines to carry U.S. gas to Mexico would be the first major midstream assets built with foreign capital since the recent reform of Mexico’s energy sector, the partners said at the time (see Daily GPI, March 27).

People

Pacific Gas and Electric Co.(PG&E) PresidentChristopher Johns, 54, said he plans to retire at the end of this year, and PG&E CEOTony Earleysaid the company’s board is expected to approve Johns’ replacement before the retirement is effective. Johns joined PG&E in 1996 as vice president and controller, following a career as a certified public accountant atKPMG Peat Marwick LLPwhere he was a partner. He was named PG&E CFO in 2005 and became the utility president in 2009.

Industry Briefs

Sempra LNG, a unit ofSempra Energy, andWoodside Petroleum Ltd.have a nonbinding agreement to explore developing Sempra LNG’s proposed liquefied natural gas (LNG) project in Port Arthur, TX. The project would be at a site previously permitted for an LNG regasification terminal and designed to include two liquefaction trains with a total export capability of about 10 million tonnes per annum, or 1.4 Bcf/d, as well as LNG storage tanks and marine facilities for ship berthing and loading. In March Sempra LNG affiliate Port Arthur LNG LLC began theFederal Energy Regulatory Commissionpre-filing review for the facility and filed its permit application with theU.S. Department of Energyfor authorization to export LNG to all current and future free trade agreement countries (seeDaily GPI,March 23).

Industry Brief

The Department of Interior’s Bureau of Land Management (BLM) is extending until June 19 the public comment period on its advance notice of proposed rulemaking (ANPR) for potential updates to rules governing oil and natural gas royalty rates, rental payments, lease sale minimum bids, civil penalty caps and financial assurances. A comment period was launched in April to consider allowing BLM to adjust royalty rates for drilling on public lands (see Daily GPI,April 17). Notice of the two-week extension is scheduled to be published Wednesday (June 3) in the Federal Register. Potential changes to BLM’s regulations would respond to concerns expressed by the Government Accountability Office, Interior’s Office of Inspector General and others that the existing rules lack flexibility and could be causing the United States to forgo significant revenue to the detriment of taxpayers. The ANPR also addresses the value of oil and gas resources by inviting comment on how the BLM might update its rules regarding the minimum acceptable bid that must be paid for leases in auctions and and the annual rental payments that are due after a lease is obtained.

Industry Briefs

The Railroad Commission of Texas will host the Oil and Gas Regulatory Conference and Technical Workshop July 14-15 in Austin at the AT&T Executive Education and Conference Center. The conference will educate and train oil and gas industry representatives on the laws, agency rules and procedures for hydrocarbon production in Texas. This year’s general sessions feature presentations by Chairman Christi Craddick and Commissioner Ryan Sitton. In addition, Commissioner David Porter will host the Texas Natural Gas Panel. The conference and technical workshop also offers 48 breakout sessions covering a variety of topics including new online filing of Form GW-1, “Groundwater Protection Determination Request Form;” processing the Form T-4, “Application for Permit to Operate a Pipeline in Texas and mapping requirements; new online filing of Statewide Rule 13 Surface Casing Exceptions; and Legal Enforcement Hearings. The fee for the conference is $400 per person if registered by June 12 and $475 per person if registered by July 1, which is when registration closes. Registration is limited to 500 participants. For information, visit the commissionwebsite.

Summer NatGas Demand Seen as Manageable, Thanks to Ample Shale Gas, Lack of ‘Big Heat’

Thanks to a strong El Nino event that is expected to sweep the United States this summer and ward off significant heat waves in key population centers, the demand for air conditioning is expected to be on the low side, which in turn will keep pressure off of natural gas supplies, according to Weather Services International (WSI) and ESAI Power LLC.

Industry Brief

Tall Oak Midstream LLC is constructing a crude oil gathering, storage and transportation system to serve producers in Oklahoma’s STACK play. Tall Oak is currently gathering and processing natural gas on its STACK System for multiple customers. Anchored by a long-term agreement with Felix Energy LLC, the crude oil system will connect to multiple downstream pipelines that provide access to the market center at Cushing, OK. Tall Oak said it expects to bring the system into service by the fourth quarter. “This expansion provides one-stop shopping and marketing flexibility to Felix Energy and many other customers we are working with in the STACK play,” said Tall Oak CEO Ryan Lewellyn. Tall Oak’s initial crude oil system will consist of a storage and truck unloading facility east of Okarche, OK, in the center of the STACK play, and a 20-mile pipeline that will provide connection to multiple downstream markets. Ultimately, Tall Oak expects to construct a 210-mile gathering system that will provide wellhead service. To serve customers while the gathering system is under construction, Tall Oak has contracted for a fleet of dedicated trucks that will deliver crude oil from the wellhead to the terminal. The terminal will have an unloading capacity of 16,000 b/d and storage capacity of 20,000 bbl with plans to expand to 70,000 bbl. The STACK play sits northwest of Oklahoma City and targets the Woodford and Mississippian-age shales.

Pennsylvania OKs Key Environmental Permits for NatGas Power Plant

The Pennsylvania Department of Environmental Protection (DEP) has approved key environmental permits for a 950 MW natural-gas fired power plant that for years Nebraska-based Tenaska has planned to build.