The global oil and natural gas industry will turn cash flow positive in 2017 for the first time since the downturn if the reduction in output promised by the Organization of the Petroleum Exporting Countries drives oil prices above $55/bbl, according to Wood Mackenzie.

Tag / Investment

SubscribeInvestment

Articles from Investment

Bill Gates-led Coalition Pumping $1B-Plus Into Energy Innovations Fund

The Breakthrough Energy Coalition, an influential group of investors and institutions led by Bill Gates that is committed to investing in technology to solve energy and climate challenges, on Monday committed more than $1 billion to back emerging technologies.

Riverstone Funding Newly Formed Mexico Energy Infrastructure Venture

Newly established Mexico energy infrastructure developer Avant Energy S. de R.L. de C.V. has received an initial line-of-equity investment of $150 million from Riverstone Holdings LLC.

Big Oil Consortium Pledges $1B in Low-Carbon Technology, Maximizing NatGas Benefits

CEOs of 10 of the biggest oil and gas companies in the world — although none based in the United States — each pledged Friday to invest an average of $100 million a year over the next decade in “climate investments” to create low-carbon technologies that would, among other things, reduce methane emissions from operations.

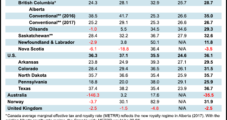

Alberta’s Flexible Royalty Regime Attracts Drilling Investment, Review Finds

Alberta has gained a profit advantage in attracting drilling and will keep the edge when oil and natural gas prices rise, according to a review of royalty revisions that take effect in 2017.

Global Oil and NatGas Upstream Spend Set to Decline for Unprecedented Third Straight Year

Worldwide oil and natural gas investments fell for the second consecutive year in 2015 by 8%, lifted by efficiencies, pummeled by weaker finances and squeezed by robust outlays in renewables, the International Energy Agency (IEA) reported Wednesday.

U.S. Onshore E&Ps Eye Smaller, Strategic Deals, While Big Oil Brethren Look Overseas

Big Oil is throwing down investments worldwide to expand long-term reserves, while producers focused on the U.S. onshore have smaller, strategic dealmaking underway in the heart of the country, mostly in the Permian Basin and Oklahoma’s myriad, stacked reservoirs.

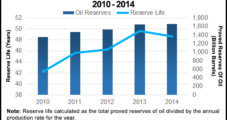

Sidelined Projects Foretell Shortfall in Oil, NatGas Reserves, Say BP, Statoil Economists

The United States last year reinforced its position as the world’s largest natural gas and oil producer, “but don’t be fooled” by the comparative resilience because the sharp pullback in investments may foretell reserves shortfalls within a few years, BP plc’s chief economist said Wednesday.

Post Oak Prowling For More U.S. Upstream Investments

Houston-based Post Oak Energy Capital LP, which already has equity investments in several North American upstream operators, said Tuesday it has raised $600 million for a third fund to pursue the same strategy.

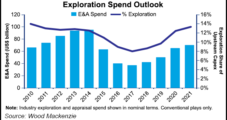

Global Reserves Shortfall Forecast If Producers Eschew Exploration Investments

The global oil market faces a supply shortfall of 4.5 million b/d by 2035 if exploration success — and investments — aren’t stepped up, Wood Mackenzie researchers are forecasting.