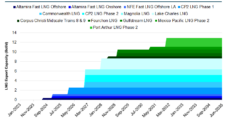

House Republicans are refining their arguments about the impact of the Department of Energy’s (DOE) pause on new LNG export permits, this time focusing on the Gulf Coast economies of Texas and Louisiana. Members of the Energy, Climate and Grid Security Subcommittee met in Port Arthur, TX southeast of Houston, for a field hearing focused…

House

Articles from House

Brief — California Energy Grants

The California Energy Commission (CEC) is targeting the natural gas-consuming food processing industry with $57 million in grants provided by the Greenhouse Gas (GHG) Reduction Fund. The grants are aimed at adopting advanced energy efficiency and renewable energy technologies. CEC is offering grants to two tiers of potential projects. Individual grants of $100,000 to $3 million are available for commercial equipment upgrades, while $2-8 million in grants would be available for emerging technologies to reduce GHG emissions. More information is available at the Food Production Investment Program.

Pennsylvania’s Legacy Oil, Gas Production Addressed in Legislation

Republican lawmakers in the Pennsylvania House and Senate have introduced companion bills that would enact an updated version of the Oil and Gas Act of 1984 to clarify language and address the current challenges facing conventional producers

West Virginia Co-Tenancy Legislation Advances to House Floor

This year’s version of legislation that would make it easier for West Virginia’s natural gas producers to block up acreage for longer laterals by gathering leaseholders into large tracts has passed committee and is scheduled for its first reading before the full state House of Representatives on Tuesday.

Tax Reform Bill Headed to Senate After Winning House Passage

House Republicans passed a $1.5 trillion comprehensive tax reform bill on Tuesday that lowers the corporate tax rate from 35% to 21% and preserves important tax credits used by the oil and gas industry.

NAFTA Defended as Boon for U.S. Energy Sector in House Hearing

Representatives from the energy, business, manufacturing and academic sectors told a House subcommittee on Wednesday to “modernize” but not blow up the North American Free Trade Agreement (NAFTA), arguing that it’s essential to the nation’s energy growth.

Industry Keeps Up Fight as Possible Pennsylvania NatGas Tax Lingers

Another voting session came to an end in the Pennsylvania General Assembly on Thursday with no action on the latest severance tax legislation for unconventional natural gas production.

DOE’s Grid Resiliency NOPR Target of Sharp Criticism at House Subcommittee Hearing

All six witnesses at a House Committee on Energy and Commerce subcommittee hearing Thursday said they oppose for both process and substance reasons the Department of Energy’s (DOE) recent proposal to provide reliability and resiliency compensation to coal and nuclear baseload generators. Several subcommittee members were sharply critical of the proposal as well.

House $1.2T Funding Package Nixes Obama-Era Energy Rules, But Senate Future Uncertain

House lawmakers passed a $1.2 trillion package of appropriations bills for the next fiscal year on Thursday, but not before Republicans successfully added four amendments targeting Obama-era rules, including those governing methane emissions and the “social cost of carbon.”

Brief — PA Impact Fee

The Republican-led Pennsylvania House energy committee has voted 15-11 along party lines for an amendment to change the name of the state’s “impact fee” to “severance tax.” The committee hasn’t voted to move the amendment to the House floor. In a procedural move, the amendment would block a resolution filed by Democrats to bring a severance tax bill to the floor for a vote. It also comes after the state Senate passed a revenue package to fund the state budget that calls for establishing a severance tax on unconventional natural gas production. The impact fee was established in 2012 and is charged annually on nearly all unconventional wells in the state during their first 15 years of operation. Producers have paid more than $1.2 billion in impact fees for distribution to local communities and state agencies since it was enacted. House energy committee Chairman John Maher told local news media that changing the impact fee’s name would help to demonstrate that producers have a significant tax burden in the state.