October natural gas is expected to open a penny higher Wednesday morning at $3.99 as traders balance a historically strong performance of the October contract against the outlook for plump storage injections going forward. Overnight oil markets recovered somewhat from Tuesday’s drop.

Evans

Articles from Evans

Weather, Technicals Point Lower, Yet August Seen 2 Cents Higher

August natural gas is expected to open 2 cents higher Monday morning in spite of weather forecasts calling for moderation and a weak technical picture. Overnight oil markets fell.

End of Big Storage Builds Predicted; July Called 2 Cents Higher

July natural gas is set to open 2 cents higher Wednesday morning as traders balance the end of 100-plus Bcf builds in Thursday’s government storage report with weather forecasts showing a cool trend in the nation’s mid-section. Overnight oil markets were mixed.

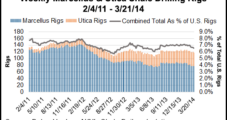

Record-Setting Storage Pulls Likely to Intensify Appalachian Drilling, Magnum CEO Says

This year's record-setting gas storage withdrawals, combined with developing acreage positions, superb reservoir quality and the momentum…

Magnum Hunter Building Out Appalachian Assets

Magnum Hunter Resources Corp. is expanding its operations in the liquids-rich Marcellus Shale.

Storage Build Passes Quietly; Traders Eye Winter Month Price Breakout

The Energy Information Administration’s (EIA) Thursday morning report that 23 Bcf was injected into underground storage for the week ended April 6 received little fanfare from traders as May natural gas futures traded a slim 9-cent range before settling at $7.924, up 6.9 cents on the day. Instead, attention was paid to the winter 2008 contracts, some of which have recently cracked the $10 price level.

Industry Briefs

Higher interest expenses and new costs related to a fiber optics project sent third quarter earnings for Columbia Energy Group downward last week, failing to measure up to forecasts by First Call/Thomson Financial analysts. Herndon, VA-based Columbia reported income of $19.5 million, or 24 cents per share, came in under analysts’ expectations of 29 cents per share. For the third quarter of 1999, Columbia had reported earnings of $20.5 million, or 25 cents per share. Still, after adjusting for one-time items, Columbia’s third quarter income from continuing operations was $32.4 million, which is $6.2 million more than third quarter 1999. Even with lower labor costs and higher natural gas prices, the company could not offset the impact of higher interest expenses associated with its pending takeover by NiSource Inc., which is scheduled to close Nov. 1(see NGI, July 10, June 5). Columbia also said that it had additional costs associated with building a fiber optics network between Washington, D.C. and New York City. CEO Oliver G. Richard III said, “Columbia’s core businesses continue to achieve solid operating performance. Our transmission, distribution and exploration and production segments all reported higher results this quarter compared with a year ago.”