NGI The Weekly Gas Market Report | E&P | NGI All News Access

Storm Clouds Brewing In Mexico As Prospects for Pemex, Economy Worsen

Mexico suffered a one-two punch from Fitch Ratings and Moody’s Investors Service Wednesday, due largely to uncertainty surrounding national oil company Petróleos Mexicanos (Pemex) and concerns over its impact on the country’s economic prospects.

Fitch downgraded Mexico’s long-term foreign currency and local currency issuer default ratings (IDRs) to ”BBB’ from ”BBB+’ and revised the outlook to stable from negative.

“The downgrade of Mexico’s IDRs reflects a combination of the increased risk to the sovereign’s public finances from Pemex’s deteriorating credit profile together with ongoing weakness in the macroeconomic outlook, which is exacerbated by external threats from trade tensions, some domestic policy uncertainty and ongoing fiscal constraints,” Fitch said.

Moody’s, meanwhile, changed the outlook for the government’s ratings to negative from stable, citing “the rating agency’s concern that the policy framework is weakening in two key respects, with potential negative implications for growth and debt. First, unpredictable policymaking is undermining investor confidence and medium-term economic prospects. Second, lower growth, together with changes to energy policy and the role of Pemex, introduce risks to Mexico’s medium-term fiscal outlook, notwithstanding the government’s near-term commitment to prudent fiscal policy.”

Fitch highlighted that “Pemex’s tax bill (oil accounted for 2.3% of GDP in federal government revenue in 2018) exceeds its FCF,” or free cash flow, “preventing it from investing sufficiently to maintain production and reserves. Fitch expects oil output to contract by 5% in 2019 and 2020.”

Pemex’s gross natural gas production fell by 3.6% year-over-year to average 3.697 Bcf/d in April, while crude oil output dropped 10.3% to 1.675 million b/d.

President Andrés Manuel López Obrador has pledged to help Pemex reach production of 2.4 million b/d by 2024 by giving it a larger upstream budget and reducing the firm’s fiscal burden.

However, the president’s efforts to rescue Pemex, combined with his austerity measures in the public energy sector, have drawn criticism from rating agencies and analysts.

“Despite a continued debate over how much money Pemex ultimately requires to reverse its multi-year production and reserves decline, no amount of money alone will resolve what ails the company in our view,” analysts at IPD Latin America LLC said in a note published Wednesday.

They explained, “Austerity measures implemented across the board are having the opposite impact intended as a major exodus of personnel is taking place at Pemex, as well as throughout government-related energy sector entities.”

Fitch senior director Gregory Remec expressed a similar view Tuesday in a panel discussion moderated by NGI’s senior Mexico editor Christopher Lenton at the Mexican Energy Forum in Mexico City, saying, “One thing that I am learning is how politicized it really is … on the regulatory front, the agencies are being depleted.”

Analysts Cite Multiple Red Flags

The brain drain and oil output decline are not the only warning signs worrying IPD analysts.

“Electricity blackouts and natural gas curtailments that have emerged over the last few months will have further economic impact in the months to come and speak to structural problems,” the IPD note said, adding, “Industrial production contracted by 2.6% in March compared to one year ago, and by 1.3% compared to February. With industrial production representing 30% of GDP, the threat of looming credit downgrades becomes all the more acute.”

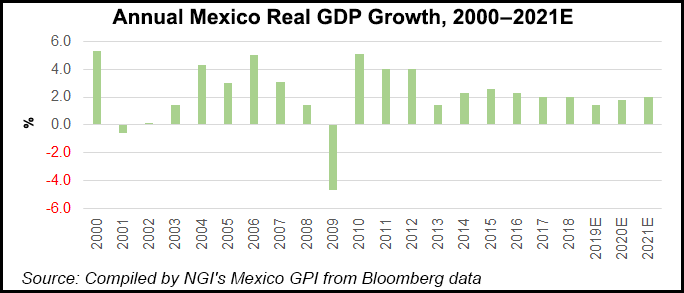

Fitch said, “Growth continues to underperform, and downside risks are magnified by threats by U.S. President Trump to impose tariffs on Mexico from June 10 (starting at 5% and rising by a further 5% per month up to a potential 25%) to compel it to stop the flow of migrants across its territory into the U.S., amid a pattern of trade uncertainty,” adding that it expects Mexico’s five-year GDP growth to average “2.6%, below the ”BBB’ median of 3.6%.”

López Obrador responded to the rating agencies in his daily morning press conference Thursday, saying, “We respect this opinion,” but he nonetheless expects Mexico’s economy to grow by at least 2% in 2019 and to average 4% per year during his term, which ends in 2024.

Fitch, meanwhile, said that, “Although full-year GDP growth reached 2% in 2018, the pace of growth decelerated during the year and the economy only narrowly avoided recession, as growth was flat in 4Q2018 before contracting 0.2% q-o-q (1.25% y-o-y) in 1Q2019.”

“Fitch expects growth to accelerate from 2Q but despite this it will reach only 1% in 2019; this would be consistent with a pattern of slower growth in the first year of a new administration.”

The note continued, “Lower inflation and higher wages (stemming from rises in the minimum wage) should support consumption, but the energy sector, characterized by a trend in falling production at Pemex, and weaker investment levels, reflecting lower business confidence, will continue to weigh on growth. The suspension of private sector bidding rounds that had been scheduled as part of the energy sector reforms is unlikely to help investment sentiment.”

Moody’s, for its part, said it expects growth to slow to 1.5% in 2019 from 2% in 2018, saying, “Mixed messages, unexpected policy announcements and reversals, such as the government’s recent lack of clarity on the use of the Stabilization Fund for Budgetary Revenues, are introducing elements of policy uncertainty and unpredictability, which are weighing on investor sentiment and growth prospects.”

“Inability to articulate and execute a clear set of policies has eroded the credibility of the administration’s economic program.

Wednesday’s sovereign rating actions follow a two-notch downgrade by Fitch in January of Pemex bonds to ”BBB-” from ”BBB+,’ citing the company’s negative free cash flow, industry-leading debt load, and onerous tax burden.

On Thursday, Fitch followed its country rating change by downgrading Pemex yet again, reducing its debt to junk status. Moody’s also followed its sovereign change by downgrading its outlook on the state oil giant from stable to negative.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |