Markets | Natural Gas Prices | NGI All News Access | Shale Daily

Spot Prices Climb, Natural Gas Futures Fall Ahead of Wintry Mix

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 2158-8023 |

Earnings

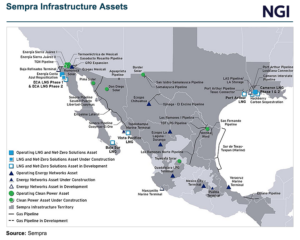

Sempra is betting on substantial growth in global LNG demand over the coming years despite regulatory uncertainty over the future of U.S. exports, management said. CEO Jeffrey Martin hosted a conference call to discuss first quarter 2024 earnings for the San Diego, CA-based energy firm. Through its Sempra Infrastructure unit, the company has nearly 40…

May 10, 2024Infrastructure

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.