E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

So Long, DUCs; PUCs Are The Future as Drilling Pace in Permian May Not Be Sustainable

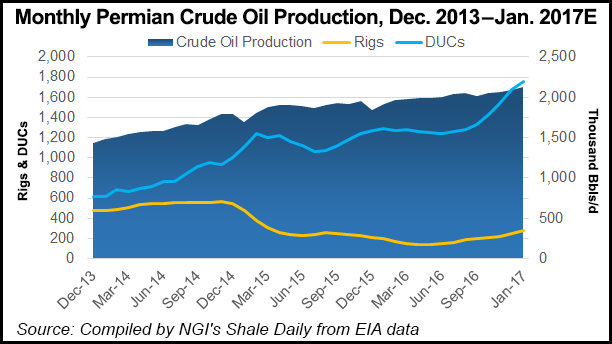

The pace of drilling activity in the Permian Basin cannot be sustained as a lack of takeaway capacity will inevitably lead to a backlog of drilled but uncompleted (DUC) wells in the Permian Basin (PUC), some analysts say.

As of Feb. 17, there were 303 rigs operating in the Permian Basin, up just two from the previous week but a gain of 84% from year-ago levels, according to the Baker Hughes Inc. rig count. Moreover, NGI calculates that since the cyclical low rig count on May 13, 2016, active rigs working the Permian have grown at an astounding annualized trend-line rate of 184% per year.

Part of the attraction in the Permian isn’t necessarily about profoundly better well economics, but more about the stacked pay potential in the basin, BTU Analytics’ Kathryn Miller said. Stacked pay plays are ones in which there are multiple productive oil and gas formations on the same piece of land. One well bore can pass through several formations.

But a lack of infrastructure in the region, manpower limitations, sand shortages and insufficient global demand threaten the rapid growth in the Permian, Miller said.

“While you see natural gas production taking a good amount of the capacity being built out in the Northeast, it’s not necessarily the same in the crude market,” Miller said at BTU’s “What Lies Ahead” conference earlier this month in Houston.

There is not enough crude infrastructure in place in the Permian, which could mean all the drilling taking place in the basin could lead to a backlog of DUCs if infrastructure enhancements don’t show up in the market when they’re needed, she said. “DUCs are so 2016. PUCs are the future.”

In recent weeks, however, two new pipeline expansions have been announced in the region, which will ease outbound pipeline takeaway constraints that had been anticipated to occur as early as mid-2017, according to data and analytics company Genscape Inc.

BridgeTex announced a 100,000 b/d expansion of its system, which is anticipated to come online in the second quarter of 2017. Cactus also announced an expansion, which would bring its system to 390,000 b/d from the current capacity of 250,000 b/d, and is anticipated to be in service in the third quarter of 2017.

“With these additions, it now looks like capacity constraint issues could be pushed into late 2017, before the 450,000 b/d Midland-to-Houston pipeline comes online in early 2018,” Genscape’s Jodi Quinnell, oil product manager, said.

Miller agreed that the Midland-to-Houston project would help to relieve local bottlenecks in the region, along with the Permian Express expansion. ExxonMobil last November formed a joint venture with Sunoco Logistics Partners LP — Permian Express Partners LLC — to expand crude oil transportation options to Gulf Coast refineries for not only Permian production, but growing output from the Ardmore Basin in Oklahoma.

The partnership “establishes a stronger crude oil logistics network to meet market demand, provides additional takeaway opportunities for shippers and expands ExxonMobil’s options to supply its network of refineries,” the companies said.

Patrick Rau, NGI director of strategy and research, noted the takeaway capacity out of the Permian question “easily has been the most frequently asked about topic to Permian E&P companies so far during the round of 4Q16 earnings calls.” He doesn’t believe, however, that many of those producers seemed too concerned, especially given the industry friendly nature in Texas and New Mexico.

“Don’t discount the ability of midstream companies to build additional takeaway capacity in the region,” Rau said. “Resistance to pipeline projects has been very much in the forefront in recent months, but that is largely coming from areas where the oil and gas industry is relatively new. For example, the biggest hurdle to getting greenfield pipelines in the Appalachia region has been obtaining state permits. I don’t think that will prove to be too much of a problem in oil-friendly states like Texas. Of course, where all that growth in Permian production might ultimately be headed is another question entirely.”

Along those same lines, Miller warned that market demand itself could prove to be another hurdle for the wealth of projected Permian growth as global oil demand is insufficient to take on rising output not only from the U.S. but a host of other producers.

In November, the Organization of the Petroleum Exporting Countries agreed to its first global oil production reduction in eight years, cutting output by 1.2 million b/d, in an effort to rebalance the market.

Oil prices had been in the low $40/bbl area before the announcement and jumped about 8% on the days the news of OPEC’s production cuts hit the market. Oil prices have since risen to around $55/bbl.

Meanwhile, OPEC’s 2016 World Oil Outlook shows medium-term global oil demand outlook increasing from 93,000 b/d in 2015 to 99,200 b/d in 2021, corresponding to an average annual increase of around 1,000 b/d.

In addition to soft demand, manpower is also an issue producers are having to contend with since the massive layoffs that ensued when oil prices crashed. As such, retraining and relocation costs likely will lead to increased budgetary concerns. Hiring lead times are also expected to double in the second quarter, according to Evercore’s James West, senior managing director and partner. Evercore is a global independent investment banking firm based in New York.

“One prominent U.S. pressure pumper that we spoke to cited significant increases in staffing lead times,” he said. “This provider estimates that in the Permian Basin specifically, the 30-day lead time witnessed just two short months ago has since grown to nearly 45 days, and that this lag is liable to grow to 60 days by 2Q2017 as the industry works through warm-stacked equipment.”

To combat the challenge of breaking in new crews not trained to do the work, the pressure pumping company has begun adding its hires “to fully staffed spreads in order to expedite the training process,” West said. That has led to higher/spread labor costs “until enough workers are trained to effectively spin out another crew.”

Aside from demand and manpower, sand shortages are also a growing concern when it comes to the rapid pace of drilling activity in the Permian. A typical railcar can carry 200,000 pounds of sand, so around 60 railcars are needed to service a single Permian well requiring roughly 12MM pounds of proppant, according to Evercore research. At 300-plus rigs, each drilling 1.5 wells each month, the Permian can produce about 450 new wells per month.

“This would imply 5.4B pounds of sand is needed in the Permian every month to complete the entire inventory of wells drilled,” West said.

Takeaway capacity, not just for sand but also for trucking, water and wellsite logistics, are already strained at current activity levels, he said. “However, the number of wells spud/month today is only half of what it was at the peak in 2014. Even if service intensity trends flattened, continued increases in the Permian rig count are not sustainable unless additional infrastructure is added,” West said.

Rau estimates that Permian producers are bracing for 10-15% increases in service costs in 2017, based on 4Q16 earnings call commentary. “Most of that will be on the completion side, as spot market rig prices remain relatively weak, and as more expensive long-term rigs roll off contract and can be replaced by lower-priced spot rigs. I’ve heard of pressure pumping price increases as high as 30% from the recent low.”

The resulting price increases,West said, would inevitably push the drilling focus into other shale basins that have not yet been tested on the supply chain front.

Miller called for more activity in the Eagle Ford as many of the companies that are drilling in the Permian — companies such as EOG Resources, Conoco and EP Energy — also have acreage in the Eagle Ford. Right now, though, “they want their money in the Permian,” she said.

BTU projects Permian production to grow 1,800 b/d for the next three years and then as much as 3,000 b/d by 2022, Miller said.

Despite the challenges Permian producers face in maintaining such aggressive drilling, Genscape’s Quinnell said she doesn’t think it’s unsustainable. In fact, she projects Permian production to grow from 2.1 MMb/d to 2.8 MMb/d by year-end 2017.

“Back just a few years ago, there was nearly double the amount of rigs in the basin. Efficiencies and well productivities continue to increase, which is offsetting the rise in service cost, especially on the completion side, and companies are talking about adding more rigs over this year to the basin,” she said.

She agreed, though, that Eagle Ford economics are also strong for some operators in the current price environment, and it might be the first- or second-best acreage in many producers’ portfolios.

“Its proximity to export markets also makes it attractive. However, there does remain questions about global demand, which poses a risk for continued increases in U.S. activity if we see another downward price correction,” Quinnell said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |