Range Resources Corp. got a boost from improved commodity pricing in 1Q2021, including a 44% rise in natural gas prices and a 77% increase in natural gas liquids (NGL) prices.

The Appalachian Basin pure-play on Tuesday reported an average realized natural gas price of $2.58/Mcf compared to $1.74/Mcf a year ago.

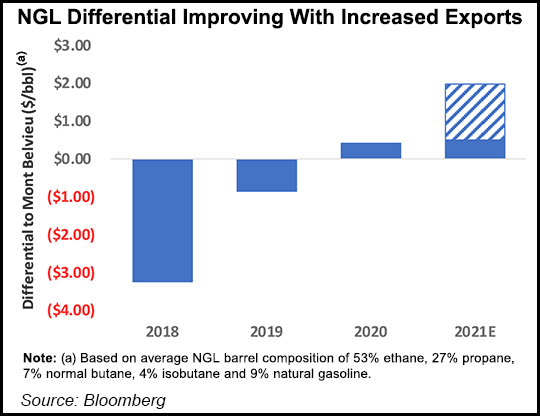

Range also reported an average NGL realization of $26.35/bbl, a 77% improvement over 1Q2020 and the highest level since 2018, CEO Jeff Ventura said Tuesday during a conference call to discuss quarterly results. The increase led to a $1.52 premium over the Mont Belvieu index, the highest in company history, he added.

Looking ahead, the Fort Worth-based company laid out a bullish forecast for NGL pricing as global demand surges.

Range’s Allen Engberg, vice...