Permian Prices Sink to New Lows Amid Broader Natural Gas Slide

Pandemonium in the Permian Basin kicked up a notch during the April 1-5 week as regional gas prices — which held below zero for much of the previous week — fell further into negative territory with trades plummeting to a fresh minus $9 low.

In a region where robust associated gas production and insufficient infrastructure sent area gas prices to steep discounts to other U.S. gas hubs for much of the last year and a half, a string of pipeline maintenance events the past couple of weeks took prices into uncharted territory.

Waha spot gas traded as low as minus $9 on Wednesday before going on to average minus $5.75. Prices bounced back on Thursday — but still ended the day below zero — after Kinder Morgan Inc. (KMI) lifted a force majeure that had been in effect since March 18 on a portion of its El Paso Natural Gas (EPNG) pipeline in New Mexico.

Still, the easing of gas flow restrictions was seen as only a band-aid on the much larger problem of inadequate gas transmission in a primarily oil-driven play. The next relief valve could arrive when Mexico developer Fermaca brings online its Wahalajara system in May, which could allow roughly 400-500 MMcf/d of additional West Texas exports.

KMI’s Gulf Coast Express is expected to add another 2 Bcf/d of takeaway capacity in October, “meaning that very low pricing is likely to persist in the near term,” Jefferies Equity Research analysts said.

On the week, Waha prices were $1.35 lower at minus $2.19. Other Permian market hubs posted similar declines.

In California, SoCal Citygate prices tumbled nearly 60 cents to $3.63, while the EPNG maintenance likely contributed to the 30-cent-plus gains seen along the pipeline over in the chillier-than-usual Rockies.

New England prices decreases losses of 20 cents or so despite the start of Algonquin Gas Transmission’s planned summer maintenance.

Meanwhile, despite significant bearish sentiment among analysts in the market, natural gas futures prices posted only small losses for the April 1-5 period as the curve shifted less than a nickel on each of the last five trading days. The Nymex May contract ended the week 4.4 cents lower at $2.664, while June fell 4.3 cents to $2.706.

The week started with some chilly air driving up demand across most of the country, but that was short lived and temperatures had moderated to far more comfortable levels by midweek. Still, the potential for a cold blast returning later this month was enough to keep prices steady of fresh storage data on Thursday, which was seen as likely reflecting the first injection of the season.

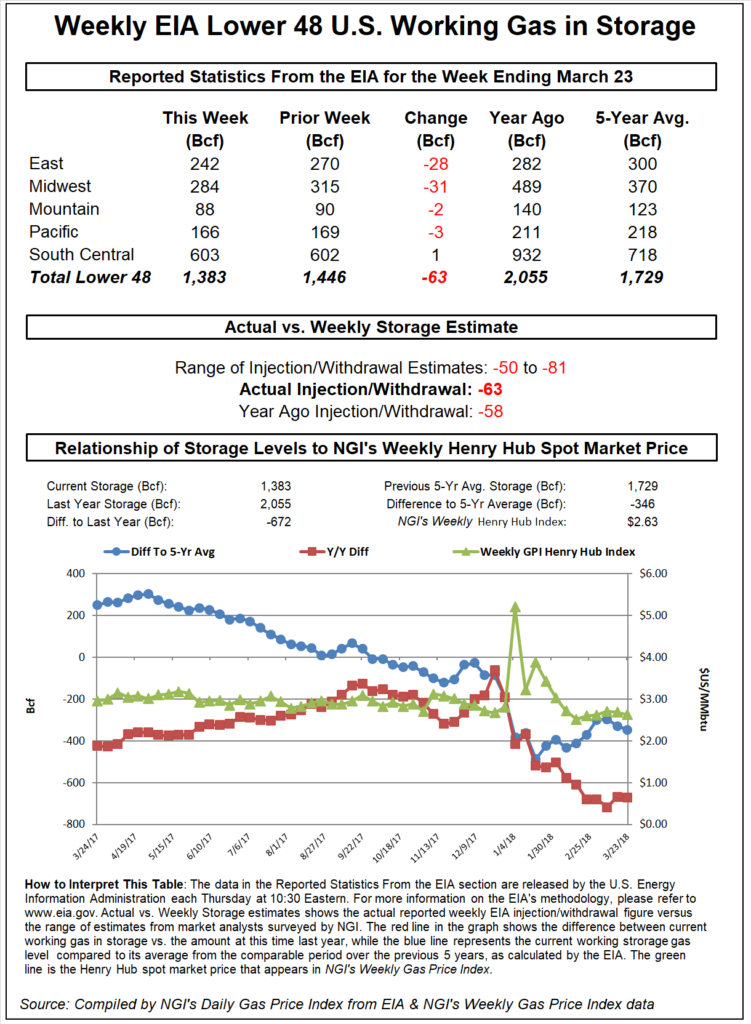

The Energy Information Administration’s (EIA) reported 23 Bcf build made a splash among traders and analysts who had been expecting an injection about half that size. The first injection of the season was also much larger than last year’s 34 Bcf withdrawal and the five-year 23 Bcf draw.

It was the South Central region’s massive 35 Bcf injection that caught the market off guard, in particular the salt dome facilities that added some 19 Bcf into inventories.

Meanwhile, deficits to the five-year average shrank to 505 Bcf from 551 Bcf the previous week, and further improvements were expected with the next two EIA reports, potentially toward 400 Bcf, according to NatGasWeather. However, due to steadily cooler trends for the April 11-18 period, the following few builds after should be close to normal.

The overnight data was slightly milder trending in most datasets to lose a few heating degree days (HDD), although that was not surprising after steady colder trends all week. The weather models maintained an exceptionally warm U.S. pattern through early next week where widespread highs of 60s to 80s were expected to result in very light national demand for this early in the year.

Demand was expected to increase late next week, however, as a series of weather systems was forecast to track across the western, central, and northern United States with widespread heavy showers and thunderstorms, according to NatGasWeather. The data has steadily added HDDs with these systems, seeing colder air arriving with them but also with greater U.S. coverage.

“Lows with these systems will mostly be in the 30s and 40s, locally 20s, so not exceptionally cold, but enough demand is likely to result in near-normal builds,” the forecaster said.

The firm expects the active pattern to last into the last week of April but with limited opportunity for much colder-than-normal conditions due to the Arctic cold pool remaining much too far north. And while the weather data could trend a little further colder April 15-21, cooler trends have failed to spark buying in recent weeks, so it would likely need to be much colder trending if a weather-driven rally is to be expected.

“Bears remain in control” and the firm expects will continue to do so “as long as front month prices remain below $2.70,” NatGasWeather said.

The Nymex May gas contract settled Friday at $2.664, up 2.1 cents on the day. June edged up 2 cents to $2.706.

Spot gas prices were lower Friday as exceptionally light demand was seen lingering over the next several days ahead of the next series of cold snaps. Losses were more substantial than they had been in recent days and especially so in the Northeast.

Transco Zone 6 NY spot gas fell more than a quarter to $2.30, and Algonquin Citygate tumbled nearly 20 cents to $2.535.

Algonquin Gas Transmission (AGT) was planning a series of maintenance events that could cut mainline capacity through mid-June. There is to be a combination of pig runs on its 26-inch mainline between the Southeast and Cromwell compressor stations (CS) and outages on the Southeast CS itself.

Southeast CS operating capacity of 1,760 MMcf/d was scheduled to drop to 1,297 MMcf/d and 1,197 MMcf/d on April 7 and 10, respectively. Furthermore, capacity through Southeast would be reduced slightly to 1,695 until June 14.

“Flows through Southeast have averaged 1,463 MMcf/d and maxed at 1,645 MMcf/d over the last two weeks, meaning up to 448 MMcf/d of scheduled flows will be impacted,” Genscape Inc. natural gas analyst Josh Garcia said.

Additionally, AGT was to conduct pig runs from the Burrillville CS to the end of the line, with station capacity reduced to 735 MMcf/d on Tuesday (April 9) and to 604 MMcf/d on April 16, potentially impacting as much as 144 MMcf/d of flows.

“The usual forms of alternative supply of downstream interconnects and LNG will be relevant if high demand materializes. However, temperatures are currently forecasted to be warmer than normal, which will mitigate the impact of these events,” Garcia said.

In Appalachia, Texas Eastern M-3, Delivery spot gas was down a quarter to $2.315, while pricing hubs further down in the Southeast fell less than a dime.

ANR Pipeline declared a force majeure in its Southeast Southern Segment, restricting flows at the Cottage Grove Southbound CS in Tennessee for gas days Friday (April 5) through April 14, which could cut up to 129 MMcf/d. The restrictions are needed to perform unexpected pipeline repairs north of its Celestine CS in Indiana.

A pipeline notice states that operational capacity at Cottage Grove Southbound would be reduced by 249 MMcf/d down to 900 MMcf/d for the duration of the event. Cottage Grove Southbound has averaged 943 MMcf/d and maxed at 1,029 MMcf/d over the past three weeks, translating to a restriction of up to 129 MMcf/d due to the force majeure, according to Genscape.

“As of the evening cycle for gas day April 5, we are already seeing a day/day drop in scheduled capacity of 123 MMcf/d,” Genscape analyst Anthony Ferrara said.

Prices across Louisiana were down no more than a nickel or so, while a dehydration unit at Enterprise Products Partners LP’s (EPD) gas gathering facility in DeSoto Parish, LA, remained offline following an explosion and fire late Wednesday. There was no impact beyond EPD’s fence line, and the fire burned itself out pretty quickly, spokesman Rick Rainey told NGI. An investigation is ongoing, and there was no word on when the unit would return to service, although the outage was not expected to be prolonged.

Midcontinent spot gas dropped as much as 16 cents. At Enable East, cash slipped only 2.5 cents to $2.435 as Enable was set to conduct integrity repairs to the AC Line running from the Chandler CS in Latimer County, OK, to the Malvern CS in Hot Spring County, AK. These repairs, expected to take place from Monday through Saturday (April 8-13), require the capacity at Chandler CS to be reduced to 500 MMcf/d.

Simultaneously, pigging runs were to be conducted on the AD line (mainline) as the AC Line anomalies are resolved. The Chandler CS is currently undergoing a planned maintenance to maintain the engines at the station which has limited capacity to 796 MMcf/d since April 2.

Furthermore, the system has experienced multiple on/off forces majeure at the Byars Lake CS upstream from Chandler in the past two weeks. “These new integrity repairs, however, will have a much more significant effect on gas flows through Chandler, which have averaged 889 MMcf/d over the past 30 days. Flows have hovered around the 1 Bcf/d mark consistently almost two weeks ago before maintenance began impacting the system,” Genscape analyst Dominic Eggerman said.

Overall, gas flows through Chandler would be cut by 389 MMcf/d until Saturday (April 13), when operational capacity will return to the previously limited 796 MMcf/d.

In West Texas, spot gas followed the rest of the country lower, but losses were limited to less than 20 cents and outright prices were far short of the records seen a few days earlier.

California’s SoCal Citygate spot gas prices plunged nearly 50 cents to average $3.355, although other pricing hubs in the state were down no more than 15 cents.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |