Permian Highway Pipeline LLC (PHP) this week launched a binding open season to solicit commitments for a project that would expand its capacity by about 650 MMcf/d, pending a final investment decision.

The expansion would bring PHP’s total capacity to about 2.75 Bcf/d.

Co-owner Kinder Morgan Inc. (KMI) announced the open season. Kinder Morgan Texas Pipeline is the operator of PHP.

A foundation shipper has already executed long-term binding transportation agreements for half of the planned expansion capacity, KMI said.

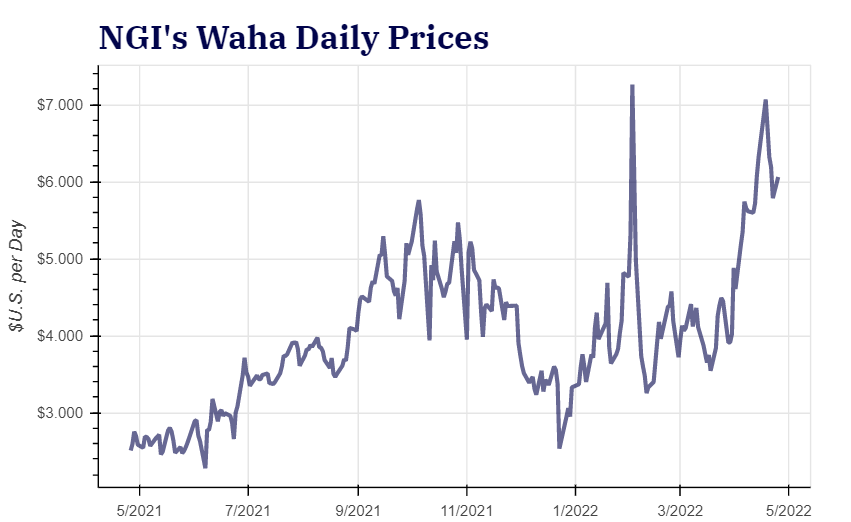

The project would primarily involve compression expansions on PHP to increase natural gas deliveries from the Waha area of West Texas to multiple mainline connections, including Katy, TX, and various Gulf Coast markets.

Pending additional customer...