Overall Balance Offsets Weak East; Futures Notch One-Month High

Natural gas prices for Friday delivery overall on average shed a penny Thursday. Traders generally elected to get their deals done before the typically volatile futures trading associated with the release of morning storage report.

Most locations flip-flopped within a few pennies of unchanged, but Northeast and eastern locations took hits from a weak next-day power market. The Energy Information Administration (EIA) storage report showed a build of 57 Bcf, well below expectations, and September futures posted the highs of the session shortly after the data’s release. At the close, September had jumped 8.5 cents to $3.545 and October was higher by 8.4 cents to $3.575. October crude oil gained $1.18 to $105.03/bbl.

A Great Lakes marketer was not pleased that his company had waited to make purchases. “We are kind of mumbling and grumbling because we waited and now we are paying more than the start of the month,” said the Michigan buyer.

“We are a little concerned because Panhandle is having some issues and we want to make sure that once we get into September and October that we can do what we think can. If Panhandle were to go down, that would cause problems. You have to allow for trouble.”

The buyer added his company did buy gas for Friday on Consumers at $3.79 and $3.81.

Next-day gas quotes around the Great Lakes showed little movement. Friday deliveries to Alliance were higher by a penny to $3.66, and quotes at the Chicago Citygates added 2 cents as well to $3.65. Gas on Consumers was seen at $3.77, about 3 cents lower, and deliveries on Michcon came in at $3.72, down about a cent. Dawn next-day gas traded hands at $4.02, up 2 cents.

In the East and Northeast, slumping next-day power prices pressured next-day gas. IntercontinentalExchange reported that Friday real-time power at the New England Power Pool’s Massachusetts Hub fell $7.03 to $41.99/MWh, and peak power into the New York Independent System Operator’s Zone A (western New York) delivery point fell $10.16 to $36.34/MWh. At PJM West Friday peak power dropped $7.83 to $41.32/MWh.

Weather forecasters also reported a trend of declining temperatures going into the weekend. Wunderground.com predicted that Boston’s Thursday high of 92 would ease to 82 on Friday and 75 Saturday. The normal late-August high in Boston is 79. New York City’s 86 high on Thursday was seen falling to 84 Friday and 79 Saturday, 3 degrees below its seasonal norm. Philadelphia’s Thursday maximum of 86 was predicted to drop to 82 Friday and 81 Saturday. The normal high in Philadelphia this time of year is 82.

Gas at the Algonquin Citygates for Friday plunged 37 cents to $3.55, and deliveries on Millennium were off by 4 cents to $3.23. On Tennessee Zone 6 200 L Friday packages fell about 21 cents to $3.52.

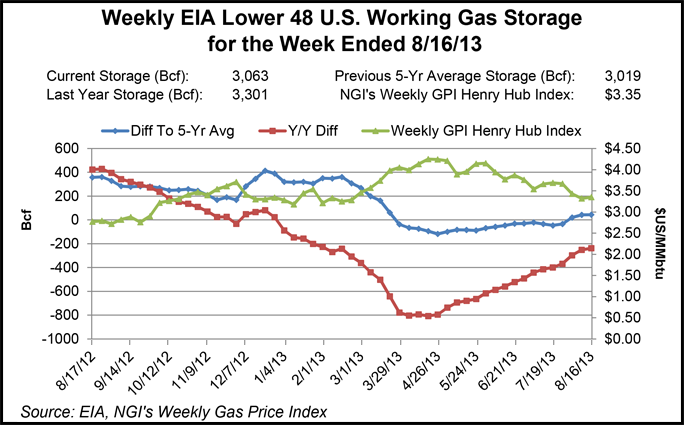

Once the EIA storage data was released, September futures posted the high of day, $3.559, and traders surmised that the thin 57 Bcf injection augured even more favorable storage reports going forward. “The data has supportive implications for the balance going forward, with below-average injections now possible for the next few weeks given the current temperatures outlook,” said Tim Evans of Citi Futures Perspective following the release of the report. “At the same time, we note that last week’s 57 Bcf build was still slightly over the 56 Bcf five-year average for the week and more than the date-adjusted 43 Bcf refill a year ago. And so while the data was bullish relative to expectations, the match with the five-year average says ‘neutral.'”

Futures got off to a fast start as forecasters adjusted their near-term outlooks even warmer overnight. MDA Weather Services in its morning six- to 10-day outlook said, “Additional hotter changes were made from the Midwest to East today. For the Midwest, this results in further expansion of much ‘aboves’ for the period composite and the inclusion of some strong above days in the Upper Midwest.

“In the East, this warmer shift brings the Mid-Atlantic into the above range instead of normal. The Southwest has turned cooler given the increasing threat of wet weather in a pattern that otherwise includes limited cool threats. Models strongly support the big picture pattern but still vary in the details, especially along the fringes of the broad ridge in the Central U.S.”

Prior to the issuance of the data most estimates were in the upper-60 Bcf area. Ritterbusch and Associates was looking for an increase of 70 Bcf, and a Reuters survey of 24 traders and analysts revealed an average 69 Bcf build. Bentek Energy’s flow model forecast a 60 Bcf addition. Last year, 43 Bcf was injected, and the five-year pace stands at 56 Bcf.

The folks at Energy Metro Desk (EMD) had a hunch there might be some wrinkles in this week’s report. “This week is going to be a bit tricky, we think,” said John Sodergreen, editor. “While the weather alone points to a build in the lower 60s range, the past few weeks of surprises, reclassifications and the like also suggest something quite a bit higher. We heard great arguments this week for downside and upside risk; and that’s no line. Considering the flows, the imports, and the weather, we think the EMD consensus should be spot on at 65.

“The consensus is all about the bulls, however. EIA seems to be coming in higher more often than not these days, but it may be time for a low one nonetheless. So we’re now thinking that the bias is leaning lower this week. So in effect, it may be closer to our 65 consensus than the market average of 69 Bcf. A surprise should be no surprise.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |