OFS Job Market Outlook Appears Grim, Particularly for North American Onshore Opportunities

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |

Markets

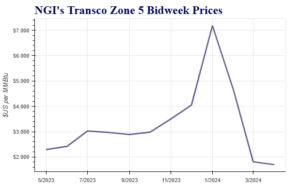

As bidweek continued into a second day Thursday (April 25), baseload prices maintained the weak tenor established in Wednesday’s opener, according to NGI’s Bidweek Alert (BWA). Deal volumes were predominantly lower from Wednesday levels. Bidweek trading concludes on Friday. Leading on volume, Dawn in the Midwest saw 249,000 MMBtu/d in total volumes traded in 64…

April 26, 2024Earnings

Haynesville Shale

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.