Natural gas futures held onto their recent gains in early trading Thursday as the market turned its attention to a potentially pivotal government inventory report, one that figured to garner plenty of interest following a bullish surprise in the week-earlier period.

Coming off a 13.4-cent rally in the previous session, the October Nymex contract was up 0.1 cents to $2.797/MMBtu at around 8:40 a.m. ET.

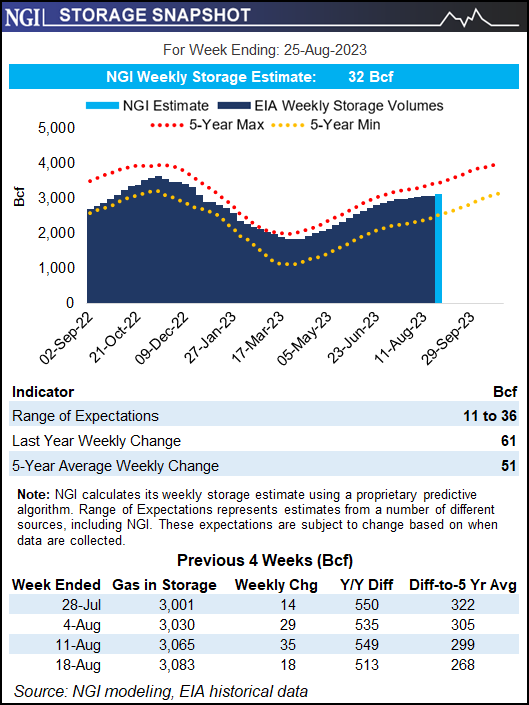

The U.S. Energy Information Administration’s (EIA) 10:30 a.m. ET storage report could corroborate, or potentially contradict, the evidence of tightening balances implied by a much smaller than expected 18 Bcf print in last week’s data release.

A Wall Street Journal survey of 12 analysts, brokers and traders produced injection estimates ranging from 11 Bcf to 36 Bcf, with...