E&P | Coronavirus | Earnings | Natural Gas Prices | NGI All News Access | NGI The Weekly Gas Market Report

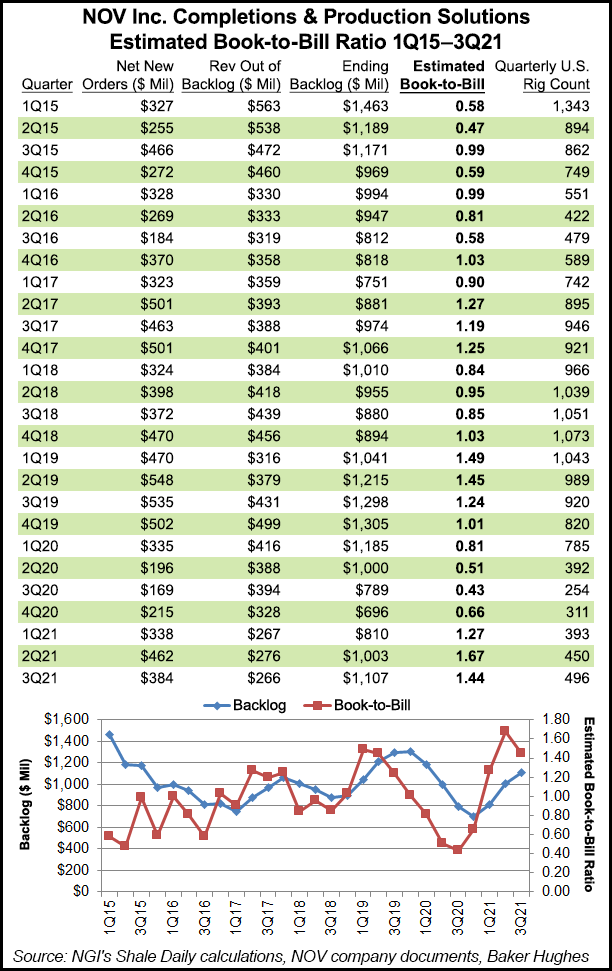

NOV’s Global Oil, Gas Orders Surpass Shipments, but Covid ‘Disruptions’ Stymie Supply Chain

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |