Forward Look | E&P | Infrastructure | Marcellus | Markets | Natural Gas Prices | NGI All News Access | NGI The Weekly Gas Market Report | Regulatory

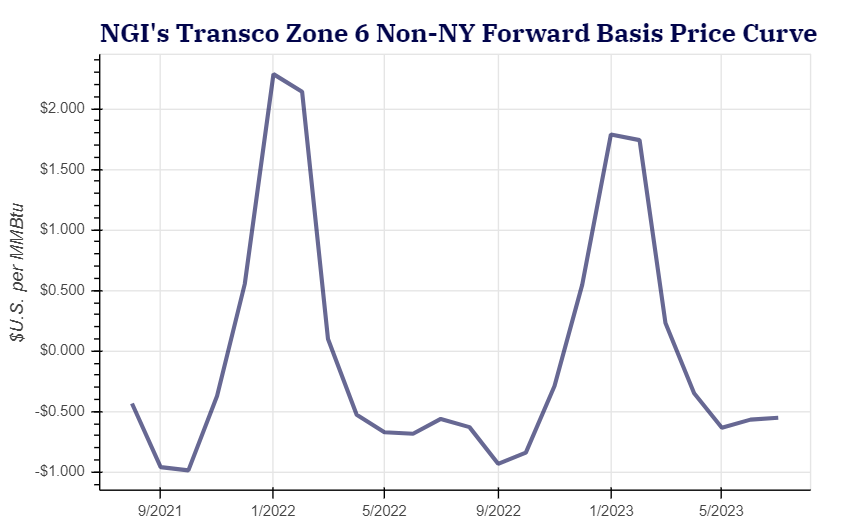

Northeast Natural Gas Forward Curve Price Strength Highlights Production, Storage Concerns

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |