Story of the day

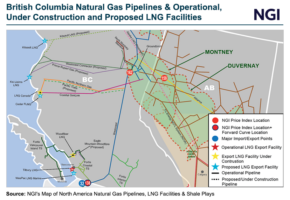

Lower Natural Gas Prices, Rising Demand Fueling Uptick in International LNG Projects, Chart CEO Says

Infrastructure

Golden Pass LNG Expects ‘Near Term’ Construction Impacts Amid Possible EPC Changes

Golden Pass LNG confirmed interruptions on the Texas export project could be coming after reported worker furloughs, citing ongoing negotiations between its engineering, procurement and construction (EPC) contractors. San Antonio-based Zachry Group informed hourly subcontractors Thursday not to come to the Sabine Pass, TX, site until further notice and referenced a “fuel shortage” issue, according…

May 10, 2024Markets

Natural Gas Futures Trim Gains From Freeport LNG Uptick, Tighter Storage

Natural gas futures were trading lower early Friday as uncertainty over near-term weather demand shifted attention away from a rebound in Freeport LNG feed gas flows and Thursday’s bullish government storage report. The June Nymex contract was down 3.5 cents to $2.266/MMBtu at around 8:45 a.m. ET. An hour earlier, the contract had been trading…

May 10, 2024Markets

Natural Gas Futures Resume Rally Mode Amid Weaker Production, Narrower Storage Surplus

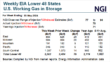

Natural gas futures flew higher Thursday, gaining ground for the fifth time in six sessions as production continued to slide and storage excesses gradually narrowed. At A Glance: EIA prints 79 Bcf Injection Output below 96 Bcf/d Summer weather nears Following a breather the prior session – a 2.0-cent dip – the June Nymex gas…

May 9, 2024Markets

Brightening LNG Demand Outlook Helping to Lift Natural Gas Forwards; West Texas Production Constrained

North American natural gas forwards rallied across the 2024 strip during the May 2-8 trading period as sagging production readings and an incrementally supportive LNG export outlook stirred bullish optimism. Benchmark Henry Hub set the tone, with June fixed prices rallying 25.5 cents week/week to reach $2.194/MMBtu, according to NGI’s Forward Look. Negative Basis in…

May 9, 2024Trending News

Infrastructure