Markets | NGI All News Access | NGI Data

New England Leads Overall Broad Decline; Futures Still Above $4.00

Gas for weekend and Monday delivery retreated on Friday, as steady weather conditions convinced traders that committing to three-day deals at elevated prices was less attractive than spot purchases using convenient electronic communications.

Price declines were most dramatic in New England, where traders shied away from quotes for Friday gas upwards of $10.00. Double-digit declines were widespread, and only isolated points in the Midcontinent and Rockies managed to record gains.

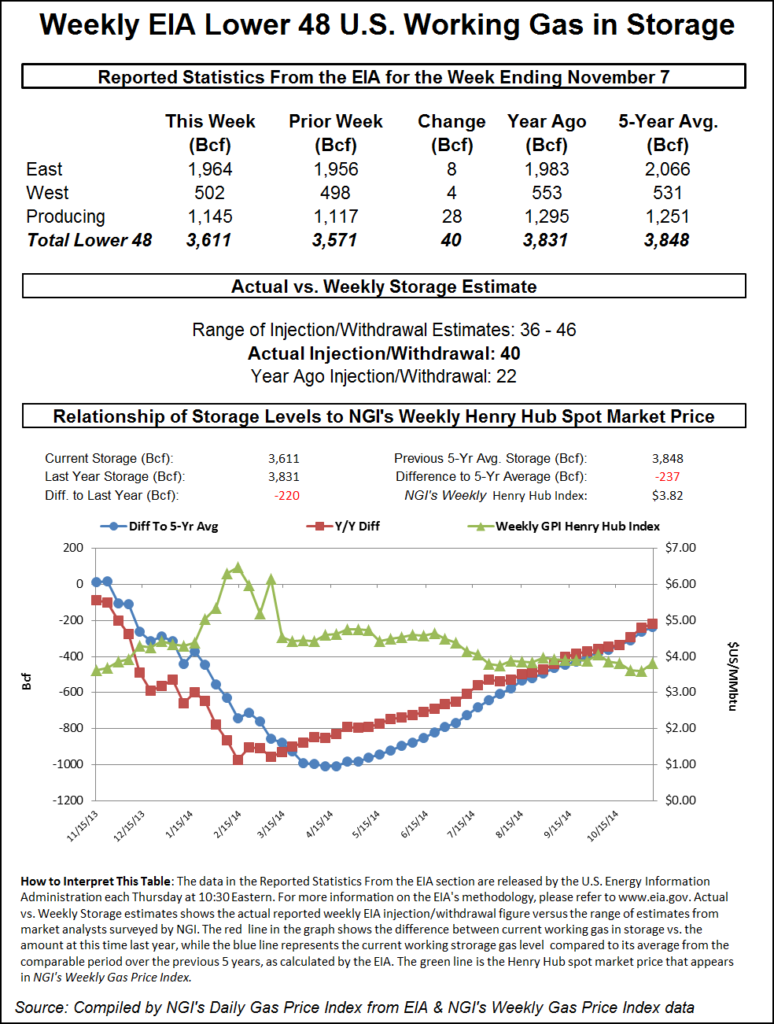

The Energy Information Administration (EIA) reported a build of 40 Bcf in its holiday-delayed inventory report, slightly above expectations, but after an initial decline, prices recovered and posted a nominal gain. At the close, December futures managed to hold the technically significant $4.00 mark and settled at $4.020, up 4.3 cents, and January gained 4.0 cents to $4.129.

Weekend and Monday gas in the Northeast fell hard in spite of weather forecasts calling for below normal temperatures. AccuWeather.com predicted Boston’s 45 high Friday would fall to 40 on Saturday and hit 45 on Monday. The seasonal norm in Boston is 52. New York City’s Friday peak of 42 was to inch up to 43 Saturday and to 45 Monday. The normal mid-November high in New York is 54. Philadelphia’s Friday high of 42 was expected to climb to 44 Saturday and 47 on Monday. The normal high is 56.

Quotes at the Algonquin Citygates plunged $3.61 to $6.50, and gas at Iroquois Waddington slid 6 cents to $4.55. Deliveries to Tennessee Zone 6 200 L shed $3.59 to $6.16.

Deliveries into the Mid-Atlantic fell by double-digits. Gas on its way to New York City on Transco Zone 6 dropped 40 cents to $3.60, and gas on Tetco M-3 was down 44 cents to $3.56.

Monday peak power prices offered little incentive to purchase incremental volumes. IntercontinentalExchange reported Monday peak power at the ISO New England’s Massachusetts Hub tumbled $12.13 to $64.06/MWh, and deliveries to the PJM West terminal fell $2.22 to $53.28/MWh.

“Waves of cold air will continue to invade the Boston area this weekend and next week and will bring another opportunity for snow,” said AccuWeather.com meteorologist Alex Sosnowski. “Much of this weekend will be dry around Boston in the wake of the snow that fell on part of the region on Thursday night into early Friday morning. The weather will be cold enough to require winter clothing for many people and to allow some ski resorts to make snow in preparation for Thanksgiving.

“Temperatures will periodically drop to the freezing mark around the city at night,” with temperatures in the 30s during daylight hours and highs in the 40s this weekend. “After a cross-country January-like storm affects the Rockies and Central states this weekend, there is a chance that rain mixes with or changes to wet snow before ending in part of the area Monday night.”

Marcellus points also weakened. Weekend and Monday gas on Millennium fell 20 cents to $3.13, and Transco Leidy was seen 21 cents lower at $2.85. Parcels on Tennessee Zone 4 Marcellus fell 11 cents to $2.53, and on Dominion South gas was quoted at $3.24, down 25 cents.

Market points in the Great Lakes and Midwest also posted losses, but not at the rate of eastern locations. Weekend and Monday parcels on Alliance fell a penny to $4.39, and at the ANR Joliet Hub gas was seen at $4.37, down 2 cents. At the Chicago Citygates, gas fell 6 cents to $4.37, and at Demarcation packages came in at $4.39, down a penny. Buyers on Consumers saw their quotes drop a penny to $4.35, and gas on Michcon fell 5 cents to $4.33.

For the week ended Nov. 7, the EIA at 10:30 a.m. EST on Friday reported an increase of 40 Bcf. December futures had fallen to a low of $3.956 after the number was released and by 10:45 EST, December was trading at $3.983, up 0.6 cent from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for an increase of about 38 Bcf. An analysis by United ICAP revealed an increase of 37 Bcf , and Citi Futures Perspective analysts calculated a 46 Bcf increase. Bentek Energy anticipated an injection of 38 Bcf.

“We were hearing anywhere from 36 Bcf to 38 Bcf, and the market came off a couple of cents,” said a New York floor trader, who expected to trade below $3.95 on Friday.

“The 40 Bcf net injection was slightly above the consensus expectation, but certainly not outside of the range, a modest bearish surprise that won’t prompt any major overhaul to overall forecasts,” said Tim Evans of Citi Futures Perspective. “Attention will quickly return to the debate over whether the current cold snap is enough to support prices from current levels, given that more moderate readings will return by the last week of the month.”

Inventories now stand at 3,611 Bcf and are 220 Bcf less than last year and 237 Bcf below the five-year average. In the East Region, 8 Bcf were injected and the West Region saw inventories increase by 4 Bcf. Stocks in the Producing Region rose by 28 Bcf.

Following Thursday’s sharp selloff top traders were on the sidelines.

“Although this market may have picked up some bearish spillover from the oil liquidation, the larger driver appears to be some further shifts in some of the private forecasts in the direction of milder temperature trends beginning later next week,” said Jim Ritterbusch of Ritterbusch and Associates. “As a result, the current cold spell is being increasingly viewed as a one-off that could impact only a couple of EIA storage reports. Furthermore, the expected temperature moderation is forcing a reassessment of supply availability with tomorrow’s supply peak likely to exceed 3.6 Tcf by a slight margin.

“And, while we expect a supportive figure with our forecasted EIA some 4-5 Bcf below average industry ideas, we look for updates to the temperature views to rule going forward as the market begins to exit the shoulder period. [Thursday’s] selloff dropped below our expected support at the $4.05 level and as a result, this chart deterioration provides a caution flag against attempts to establish a long position. We remain sidelined for now but will reassess in the light of tomorrow’s storage data as well as temperature updates.”

Whether or not the cold air pounding the country was a “one-off” event remained to be seen with calendar winter over a month away. Forecasters at Commodity Weather Group (CWG) saw a normal 11-15 day period with above normal temperatures confined to California and the desert Southwest.

“A powerful cold outbreak continues to dominate next week with good model agreement,” CWG President Matt Rogers said. “We edged Chicago and St. Louis into upper single digit low temperatures by Tuesday morning, an impressive feat for November, while we also shifted the East Coast a bit colder by the middle of next week with highs only in the upper 30s Tue-Wed for Philadelphia.

“Despite demand increases for next week, warmer changes continue to mount by the second half of the six-to-10 day into the 11-15 day. While no major warming is seen at this point, the loss of the gatekeeper and Alaskan high pressure ridging features help mix in milder Pacific air to keep the warmer risks greater than the colder ones for the overall 11-15 day. Our current scenario favors a brief warm-up in the East with a transient weak cooling by days 14-15. The models are still in good agreement on a late month stratospheric warming that favors colder risks for December.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |