Natural Gas Prices | LNG Insight | Markets | NGI All News Access | NGI The Weekly Gas Market Report | Shale Daily

U.S. Natural Gas Spot Prices to Average $3.40 This Winter and Output to Hold Near 105 Bcf/d, EIA Says

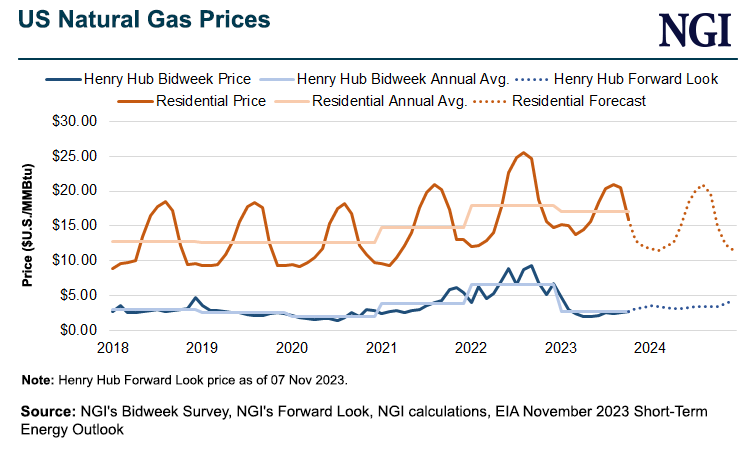

Henry Hub natural gas spot prices will average $3.40/MMBtu this winter as mild weather and strong production should help to maintain a healthy supply buffer, the U.S. Energy Information Administration (EIA) said in updated projections published Tuesday.

In its latest Short-Term Energy Outlook (STEO), EIA recorded an average spot price at the national benchmark of $2.59 for the third quarter. Prices are expected to rise to $3.26 for 4Q2023 before climbing to $3.42 in 1Q2024, according to updated STEO modeling.

Still, while prices could peak at more than $3.60 in January, the domestic natural gas market outlook for the coming winter stands in stark contrast to a year ago, according to EIA.

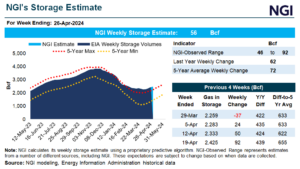

Domestic working natural gas in underground storage exited October at an estimated 3,835 Bcf, or 6% above the five-year average, EIA said. In November 2022, Henry Hub spot prices averaged $5.50, and storage inventories lagged the five-year average by 3% at the start of last winter, the agency noted.

Reflecting production strength and projections for a warmer-than-average winter, the year-on-five-year storage surplus is expected to climb to 21% by the end of the withdrawal season, according to agency modeling. That would put inventories at just under 2,000 Bcf at the end of March 2024.

“We expect U.S. dry natural gas production to average almost 105 Bcf/d during the second half of 2023, up nearly 2 Bcf/d from the first half of the year,” researchers said. “We forecast U.S. dry natural gas production will continue to average around 105 Bcf/d during the winter heating season.”

In terms of weather, the latest STEO modeled 4% fewer heating degree days for the upcoming winter versus the prior 10-year average, which would lower residential/commercial heating consumption by 2% versus five-year average levels.

“Although we expect this winter on average to be warmer than normal, we expect January and February to be colder than last year’s warmer-than-average January and February,” researchers said.

Looking at regional storage dynamics, the East, Midwest and South Central all are set to enter the winter with inventories more than 87% full, according to EIA.

“In the Mountain region, which has much less storage capacity than the other regions, we estimate storage is 98% full, the highest level on record at the end of October,” researchers said. “Pacific region storage stocks were well below the five-year average all of last winter, supporting record-high natural gas prices in the region in December 2022, but Pacific inventories have increased steadily this summer and are almost 80% full entering this winter heating season.”

SoCal Citygate spot prices peaked at nearly $50 in December 2022 and never posted a daily average below $15 during the month, Daily GPI historical data show. Forward prices at the SoCal Citygate, meanwhile, averaged $8.18 for the balance of winter (December-March), NGI’s Forward Look data showed.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |