Natural Gas Prices See Widespread Losses Despite Extreme Weather Week

With extended summer heat transitioning to a more seasonable weather pattern, weekly natural gas prices posted dramatic declines across North America. Led by steep discounts in California, the NGI Spot Gas Weekly Avg. tumbled 17 cents to $1.86.

The sharp move lower out West occurred despite chilly weather driving up demand in the region. The season’s first big snowstorm brought blizzard conditions while dumping up to 4 feet of snow in some spots. Montana, in particular, set new daily snowfall records across the state, according to AccuWeather.

The snowfall was attributed to a combination of a storm from the Pacific Ocean, cold air from northern Canada, moisture from the Gulf of Mexico and “a Northeast-ascending flow that squeezed extra moisture from the atmosphere,” AccuWeather senior meteorologist Alex Sosnowski said.

Nevertheless, SoCal Citygate prices tumbled 34 cents from Sept. 30-Oct. 4 to average $3.25. Malin was down just 9.5 cents to $2.285.

In the Rockies, Cheyenne Hub was down 20 cents to $1.455, while ongoing pipeline restrictions and the strong demand lifted Northwest Sumas some 56.5 cents to $2.95.

This week’s weather was a tale of two cities, though, as a large area of nearly stationary high pressure resulted in an “extended summer” across the Deep South and Southeast earlier in the week. Day after day, daily high record temperatures fell as many places saw the mercury soar into the triple digits. In some places like Birmingham, Alabama, thermometers exceeded 100 degrees, which didn’t even happen in July, AccuWeather said.

However, that system was expected to begin weakening and shrinking over the weekend as cooler air pushes progressively farther south, according to AccuWeather meteorologist Kyle Elliot. Starting this weekend into early next week, areas of the Deep South will enjoy cooler conditions, although some locations will still feel the heat through for a couple more days.

Houston Ship Channel weekly prices dropped 19 cents to average $2.25, and Texas Eastern S. TX fell 18 cents to $2.25.

Prices in West Texas, however, fell harder after reaching new heights since the in-service of Kinder Morgan Inc.’s Gulf Coast Express pipeline. Waha plunged 27.5 cents to $1.275.

On the futures front, volatility was on full display as traders struggled to sort through conflicting market signals.

On one hand, traders are coming to terms with production that is much higher than they thought. Pipeline scapes indicate that production is around 93 Bcf/d, but recent storage data has proven it to be much stronger, likely driven by Gulf Coast Express’ in-service.

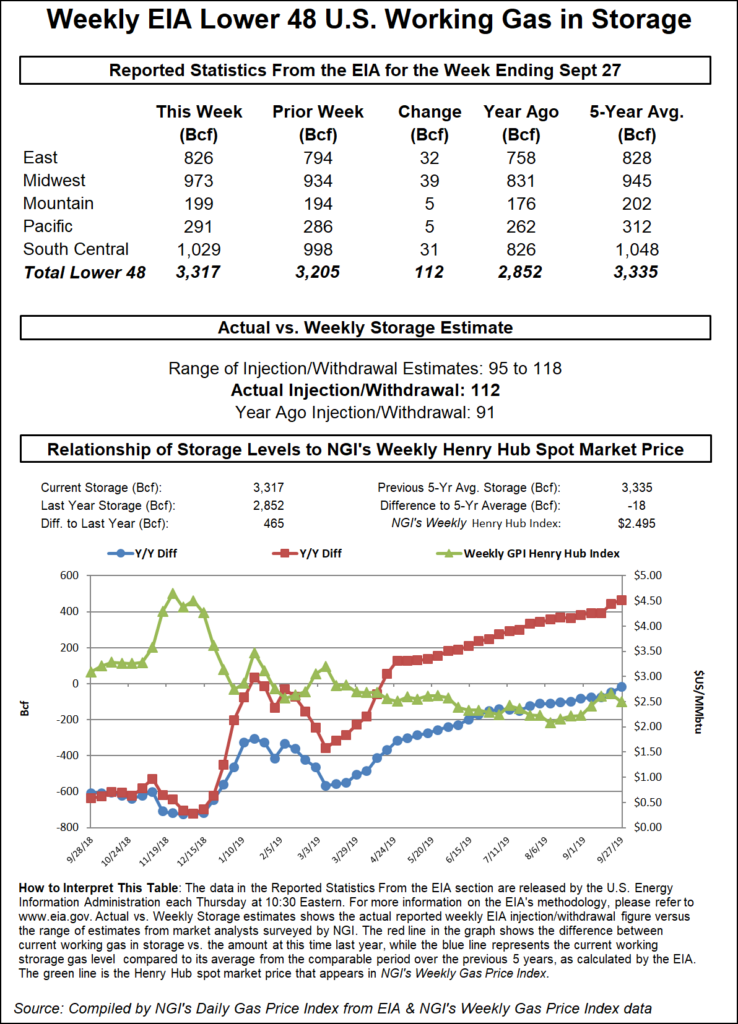

The Energy Information Administration (EIA) last week reported the first of what was expected to be several triple-digit storage builds during the last month of the traditional injection season. On Thursday, the EIA said that inventories grew by another 112 Bcf as of Sept. 27, boosting the year/year surplus to 465 Bcf and trimming the deficit to the five-year average to just 18 Bcf.

Such bearish storage data should have weighed further on prices, but hints of cooler weather by mid-October, and likely some technical trading, sent the November contract rallying. The prompt month went on to settle 8 cents higher after breezing by a couple of technical resistance levels.

On Friday, some demand was lost in overnight weather models, but the American midday model run added the demand back in, especially in the Oct. 11-15 period. Prices responded with a small uptick of another couple cents, lifting the Nymex November to $2.352.

“The move back higher is mostly due to the colder shift in weather models for the medium range forecast, as, for now, they no longer show a warm-dominated pattern that would keep demand well below normal, but show more variability, generally near normal over the next couple of weeks when totaled up,” Bespoke Weather Services said.

There have been a few runs, however, that hint at a more meaningful, lasting colder move, the forecaster said. “At this time, we still do not buy into such a full-on regime change, but confidence is lower until some of the chaos in model land dies down.”

A true regime change could occur with changes in the global wind patterns, along with potential influence from any recurving typhoons in the west Pacific, which can alter the downstream flow as well, according to Bespoke. The firm does not favor any of this occurring, but these are the main factors it will be watching.

As the Nymex natural gas curve continues to hover around the $2.50 mark, producers and consumers of methane are appropriately considering the supply and demand ramifications of a long-dated curve resting in demand-inducing/supply-inhibiting territory, according to Mobius Risk Group.

“Thus far, it has been the producers responding to price more so than end users, and in many cases to the benefit of transportation holders/marketers,” the Houston-based firm said. “As regional markets dislocate temporarily from Henry Hub, the value of owning the right to move molecules from supply basins to demand markets has increased.”

Looking ahead to next week, the market will focus intensely on whether weekend storage data is representative of a break in the recent string of triple-digit injections as well as the temperature forecast in late October, according to Mobius. A homogeneous trend in these two factors toward smaller injections and cooler forecasts “would bring the $2.50 mark back into the realm of possibility, and conversely a homogeneous trend of triple-digit builds continuing and lackluster late October heating demand would cause another test of $2.25 support.”

Cash prices in most of the United States moved lower on Friday as another round of soggy weather was taking aim on the Plains and Midwest after unleashing more snow over the northern Rockies.

“While less rain is likely to fall compared to other recent storms over the Plains and Upper Midwest, enough rain can fall to keep the soil soggy, cause isolated flash flooding and keep river and stream levels elevated in the region,” said AccuWeather senior meteorologist Brett Anderson.

Outside of thunderstorms, gusty winds were set to accompany the storm system into the early part of the upcoming week over the north/central states, according to AccuWeather. Gusts from the west and northwest, ranging from 35 mph to 50 mph, were likely from the eastern slopes of the northern Rockies to the northern Plains and western Great Lakes region.

If the weather system were to shift eastward, showers and thunderstorms were expected to sweep across the Ohio Valley on Sunday, AccuWeather said. Cooler air more typical of the season was expected to be ushered in by brisk, northwesterly winds as the storm moved away.

“Daytime temperatures will be fairly typical for early October with highs to range from the mid-50s across the north to near 70 over the Ohio Valley early next week,” although real-feel temperatures are expected to range from the upper 30s to near 40 across the North to the 50s over part of the Ohio Valley, the forecaster said Friday.

The new batch of cool air could make progress into the southern Plains and Deep South in the week ahead, ending a stretch of sizzling temperatures in a seemingly never-ending summer for some areas.

The crisper fall air sent cash prices in the Northeast plunging. Algonquin Citygate tumbled 74.5 cents to average just 80.5 cents. Tenn Zone 6 200L was down 46.5 cents to $1.215.

Forty-cent declines were the norm across Appalachia as well, while losses across the Southeast were no more than 20 cents.

On the pipeline front, Transcontinental Gas Pipe Line from Tuesday (Oct. 8) to Oct. 28 plans to conduct hydrotests on its Mobile Bay Lateral. During the outage, all deliveries on the Mobile Bay Lateral would have to be sourced from receipt locations on the lateral, including receipts from Station 85, Gulf South-Scott Mountain and Midcon Express Pine View.

Net deliveries on the lateral had averaged 889 MMcf/d over the last 30 days, although they trended downwards in the last week, according to Genscape. Major delivery points such as the two older Florida pipes, Florida Gas Transmission (FGT) and Gulfstream Pipeline, as well as Bay Gas Storage, would likely bear the brunt of the supply cut and respond bullishly.

“FGT has a variety of upstream supply options, while Gulfstream is more limited and will likely rely on increased receipts from SESH Coden, Gulf South, Sabal Trail Osceola, and possibly Destin,” Genscape analyst Josh Garcia said.

Receipts on Sabal Trail Hillabee would also likely increase as another route for Station 85 gas to supply Florida, according to Genscape. Production on the lateral from the Mobil Bay processing plant and from offshore platforms such as Tubular Bells and Yellowhammer should not be shut in. Given the milder weather outlook for the region, little price risk was seen.

In the Midwest, Chicago Citygate spot gas dropped 20.5 cents to $1.635, similar to other declines in the region and the Midcontinent.

Parts of Texas posted some of the nation’s only losses amid the lingering heat in the state. South Texas prices were up less than a dime, with Tres Palacios spot gas climbing 7 cents to $2.285. Most East Texas pricing hubs were up around a nickel or so.

West Texas prices, however, continued to plunge off recent highs following the Gulf Coast Express in-service. El Paso-Permian was down 18 cents to $1.155.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |