Denver-based Ovintiv Inc. has set up its year to avoid natural gas price swings through a hedging program that covers about 50% of volumes.

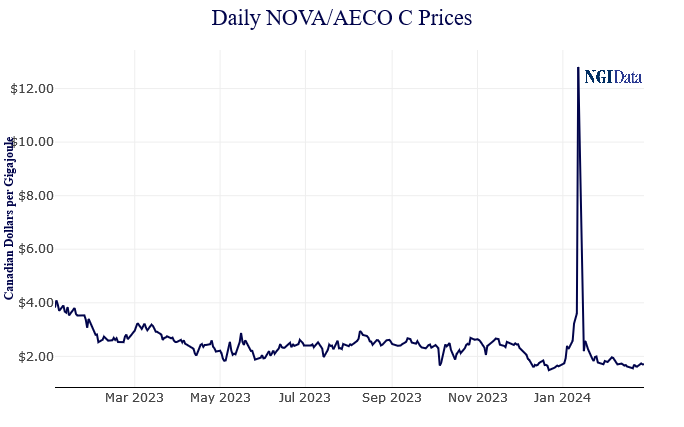

The independent, which operates across the Anadarko, Permian and Uinta basins, as well as the Montney Shale in Western Canada, has a base Nymex price assumption of $2.50/Mcf for 2024.

“More than three-quarters of our gas hedges have hard protection at prices exceeding $3, paired with upside participation to the mid-$4 range,” CFO Corey Code said during the fourth quarter earnings call. “For a 25-cent drop from our base assumption Nymex price of $2.50, the impact to our full-year cash flow would be limited to about $50 million.”

[Get Better Intel: Where are natural gas prices in Canada heading in the next few years? NGI’s Forward...