As natural gas traders and analysts prepared to unpack the latest government inventory report for evidence of tightening balances amid fading springtime production, futures hovered close to even early Thursday.

The May Nymex contract was trading at $1.837/MMBtu as of 8:41 a.m. ET, off 0.4 cents.

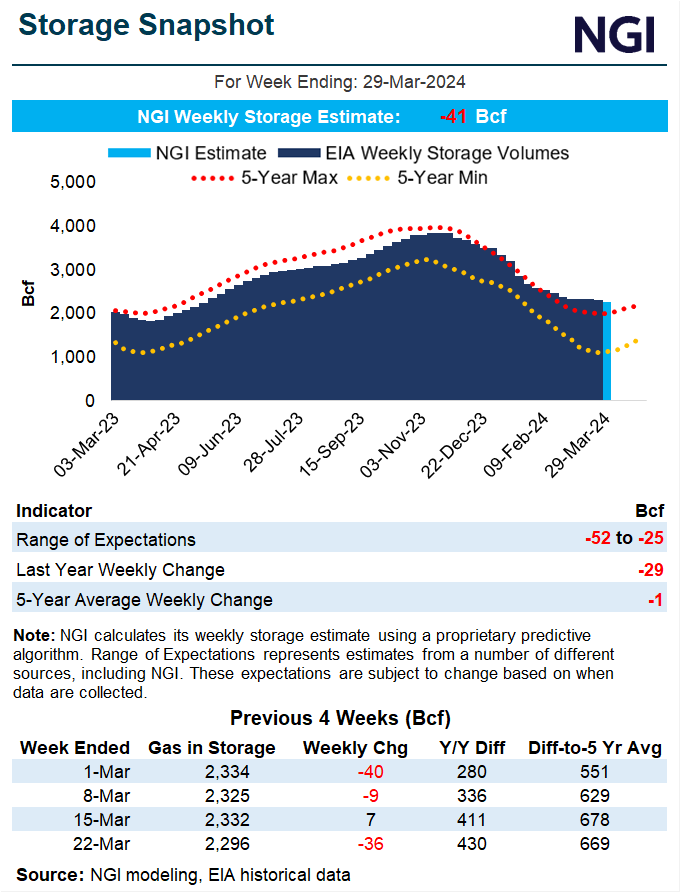

Pre-report predictions early Thursday pointed to a notably larger-than-average withdrawal in the upper 30s to low 40s Bcf for the U.S. Energy Information Administration’s (EIA) 10:30 a.m. ET weekly natural gas storage report.

A Reuters poll of 12 analysts showed withdrawal estimates ranging from 25 Bcf to 52 Bcf, with a 39 Bcf median. Estimates submitted to Bloomberg ranged from withdrawals of 35 Bcf to 52 Bcf and produced a median 42 Bcf pull.

NGI modeled a 41 Bcf withdrawal for...