MidDay Alert | Markets | Natural Gas Prices | NGI All News Access | Shale Daily

Natural Gas Futures Steady; Cash Plunging Ahead of Weekend — MidDay Market Snapshot

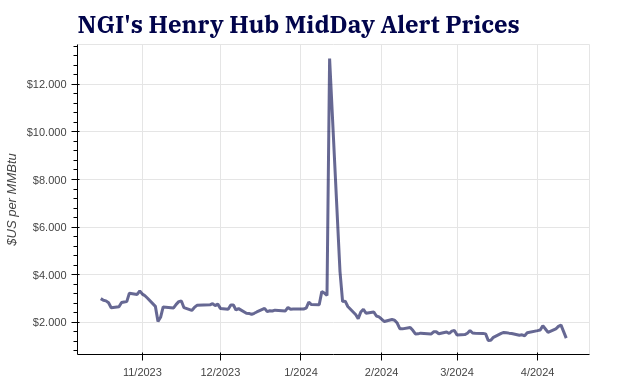

Natural gas futures were on track to finish near even at the front of the curve through midday Friday as a steep sell-off in the previous session had bulls licking their wounds. Spot prices, meanwhile, were plummeting on pleasant April weather and light weekend demand.

Here’s the latest:

- May Nymex contract at $1.773/MMBtu at around 2:30 p.m. ET, up 0.9 cents

Prices Friday were “consolidating” in the wake of Thursday’s sell-off and recent bearish developments, according to Gelber & Associates analysts. Prices came under pressure from both a high-side miss in the latest U.S. Energy Information Administration (EIA) storage data and weakness in feed gas flows to the Freeport LNG export terminal. “From a technical perspective, on both a daily and weekly basis, a close today below the $1.75 area would signal an end to the recent uptrend off of previous lows,” the Gelber analysts said.

- Liquefied natural gas feed gas flows down to 12.05 million Dth/d Friday, per NGI’s LNG Export Tracker

- Deliveries to Freeport at just 115,664 Dth/d, flow data show

Freeport LNG Development LP experienced an issue that forced the operator to restart Train 3 earlier in the week, according to a regulatory filing. The Texas export facility’s third train had previously seen extended downtime after being knocked offline during cold weather in January.

- Deep discounts on physical prices for weekend and Monday delivery, NGI’s MidDay Price Alert data show

- Henry Hub averaging $1.335, off 27.5 cents day/day, per MidDay Price Alert

- Trades as cheap as negative $5.500 in West Texas

Mild weather was on tap across the country over the next few days, NatGasWeather said Friday. Models continued to advertise “very light demand” for natural gas both for the upcoming weekend and next week, according to the firm.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9931 | ISSN © 2577-9877 | ISSN © 2158-8023 |