Natural Gas Prices | Markets | NGI All News Access

Natural Gas Futures Soften in Sleepy Close to Week; Strong California Demand Drives Cash

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

Earnings

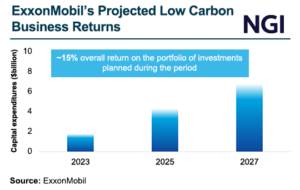

ExxonMobil will add more natural gas – including LNG – into the portfolio, both in the United States and overseas, as long as they are “advantaged investment opportunities,” according to CEO Darren Woods. During the quarterly conference call on Friday, Woods was asked whether more liquefied natural gas assets would be added to the portfolio…

April 26, 2024Earnings

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.