Markets | Natural Gas Prices | NGI All News Access | Shale Daily

Natural Gas Futures Retreat on Profit-Taking, Rising Storage Surpluses

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 2158-8023 |

Markets

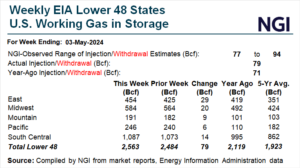

Natural gas futures flew higher Thursday, gaining ground for the fifth time in six sessions as production continued to slide and storage excesses gradually narrowed. At A Glance: EIA prints 79 Bcf Injection Output below 96 Bcf/d Summer weather nears Following a breather the prior session – a 2.0-cent dip – the June Nymex gas…

May 9, 2024By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.