NGI Mexico GPI | Markets | NGI All News Access

Natural Gas Futures Rally Big on December Contract’s Last Day; Struggles Continue for West Texas Cash

Natural gas futures rallied into the front month expiration Wednesday, with forecasters pointing to colder medium-range trends that could encourage the bulls as the market turns its attention to the January contract. In the spot market, weakness in West Texas continued as moderating forecasts saw Mid-Atlantic and Southeast prices pull back; the NGI National Spot Gas Average added 12.0 cents to $4.465/MMBtu.

The December Nymex contract rolled off the board at $4.715, up 45.3 cents on the day after trading as high as $4.806. January settled at $4.699, up 40.7 cents. February added 37.7 cents to settle at $4.538, while March settled at $4.219, up 31.0 cents.

Bespoke Weather Services attributed some of the gains earlier Wednesday to overnight weather data that had increased heating demand expectations and strong prices in the physical market.

“We did expect to see some upside” on Wednesday, “given the December expiry and recent strong physical prices, but what followed was surprising as it appeared a major player had gas liabilities for December, forcing them to buy up the December contract dramatically into expiry,” Bespoke said. Model guidance that intensified cold risks through the first week of December and delayed the start of warmer temperatures expected to arrive around Dec. 10 “likely added fuel to the fire in the run-up, with prices not reversing as much post-expiry as we would have expected.

“Still, we struggle to justify prices above the $4.50 level right now even with significant medium-range cold given expectations that beyond Dec. 10 we see at least a temporary easing of the pattern. Though that has been thrown weakly into question, there remains strong atmospheric support for it,” according to the forecaster.

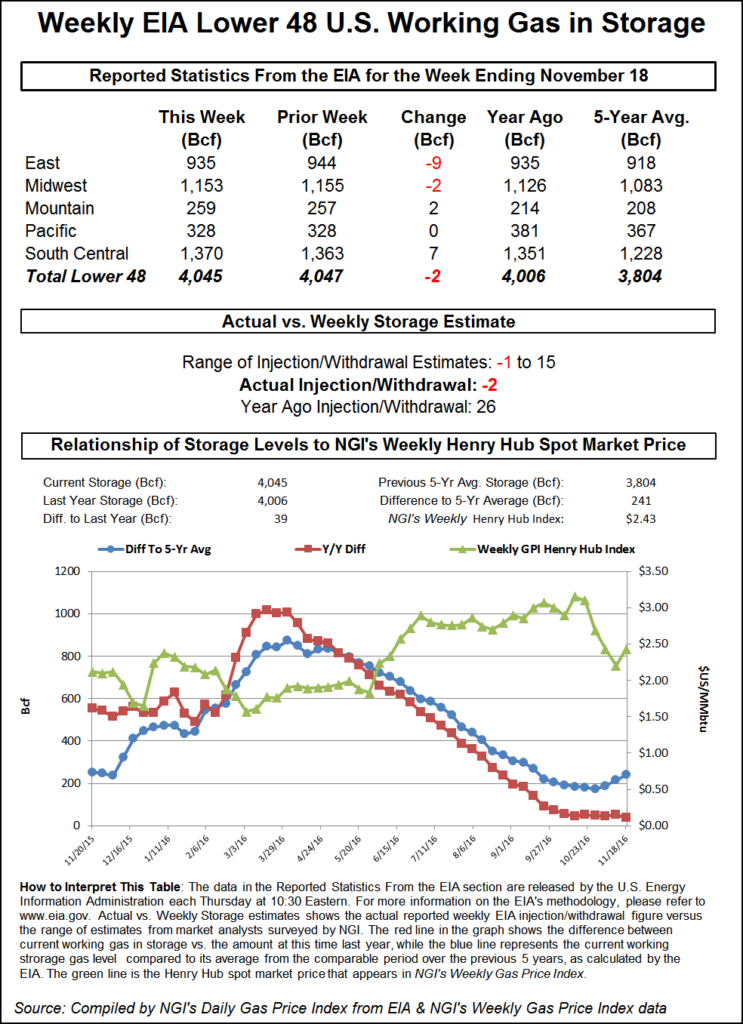

Meanwhile, estimates for this week’s Energy Information Administration (EIA) storage report, due on Thursday, showed market participants expecting a larger-than-average withdrawal for the week ended Nov. 23.

A Reuters survey of traders and analysts showed respondents expecting an average 77 Bcf pull for the week, with a range of minus 62 Bcf to minus 105 Bcf. A Bloomberg survey produced a median withdrawal of 82 Bcf, with predictions ranging from minus 60 Bcf to minus 88 Bcf. Intercontinental Exchange EIA financial weekly index futures settled Tuesday at a withdrawal of 65 Bcf.

Energy Aspects issued a preliminary estimate for a 63 Bcf pull from U.S. gas stocks for this week’s report.

“We expect the withdrawal rate to be cut nearly in half” for the latest report period, the firm said. Though gas-weighted heating degree days were only marginally lower week/week (w/w), “a 4.0 Bcf/d w/w giveback in the power sector combined with a holiday impact in the industrial sector have served to dampen demand by some 9 Bcf/d w/w.”

On the supply side, a 0.7 Bcf/d increase in production along with “marginal contributions” from liquefied natural gas sendout and net trade with Canada increased total supply by close to 1.0 Bcf/d w/w, according to Energy Aspects.

Last year, EIA recorded a 35 Bcf withdrawal for the period, and the five-year average is a withdrawal of 49 Bcf.

More Free Gas In West Texas

Physical prices in constrained West Texas continued to come under pressure Wednesday as prices strengthened across most regions. Meanwhile, expectations for moderating temperatures helped ease prices in the Mid-Atlantic and Southeast.

“Snows across New York and New England should persist into Thursday as a pair of surface lows merge and deepen offshore Maine,” the National Weather Service (NWS) said Wednesday. “…Temperatures across New England will remain below normal through Friday with some moderation expected late in the week.”

In New England, Algonquin Citygate added 22.0 cents to $5.980. Further south, Transco Zone 6 NY shed 27.0 cents to $4.525, while Transco Zone 5 dropped $1.100 to $4.510.

Radiant Solutions was calling for temperatures along the Interstate 95 corridor to gradually warm into the weekend. Washington, DC, was expected to see lows rise into the low 40s and 50s by Saturday and Sunday from the low 30s Wednesday. Further south, Atlanta was expected to see lows in the upper 20s Wednesday warm into the 40s and 50s by the end of the work week, according to Radiant.

In the Rockies, Northwest Sumas remained volatile, jumping $5.285 to average $17.055 amid ongoing constraints on supplies flowing south into the Pacific Northwest on Enbridge Inc.’s Westcoast system. The Westcoast pipeline had a system-wide operational flow order in effect Wednesday, with the operator citing reduced capacity on its T-South segment that stretches south across British Columbia to the U.S.-Canadian border.

Prices remained strong elsewhere in the Rockies and across parts of California. Opal climbed 41.5 cents to $6.115, while Malin added 41.5 cents to $6.060.

“A wet, active pattern will continue for the West over the next few days, particularly near northern California,” the NWS said. “A pair of low pressure systems will move into the West early Thursday and late Friday.” Heavy snowfall is expected for higher elevations of the Sierra Nevada mountains, including “localized amounts of up to three feet by Friday morning.

“…By Friday, precipitation will shift mostly to the higher terrain of the Great Basin with some lingering showers and higher elevation snow occurring in California and parts of the Pacific Northwest. Because of the recent burn scars and expected heavy rainfall over several days, flash flooding is a concern for parts of California.”

Meanwhile, in West Texas, Waha averaged 45.5 cents, down 19.5 cents on the day, although there were no reports of negative transactions. The low price recorded at Waha Wednesday was zero, improving on Tuesday’s low of negative 25.0 cents.

“Counter to the broader natural gas market, Permian prices have plunged in recent trading as the Waha hub averaged under $1.00/Mcf over the last three days,” Tudor, Pickering, Holt & Co. (TPH) analysts said. “While a limited sample size, we have long anticipated regional gas prices approaching zero (and potentially negative), as relatively price-agnostic supply pressures limited pipeline takeaway.”

The TPH supply model is forecasting 2.2 Bcf/d of residue gas growth between now and the start up of Kinder Morgan’s Gulf Coast Express project, which would move gas supply to the Texas coast and potentially south to Mexico.

In the interim, TPH analysts said they view the Old Ocean revamp underway in Texas to move more gas south by Energy Transfer LP and Enterprise Product Partners LP as likely to “have little impact, as its 160 MMcf/d equates to less than one month of run-rate production growth.”

A “more meaningful” bump to takeaway capacity should come from the expected completion in March of Fermaca’s La Laguna-Aguascalientes and Aguascalientes-Guadalajara pipelines,” said the TPH team, which would connect Permian gas exports to industrial demand in central Mexico.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |