Natural Gas Futures Pare Gains as Tropical Storm Activity ‘Heating Up’ in Atlantic

As traders and analysts monitored storm activity in the Atlantic and continued to digest the latest government storage data, natural gas futures pared their recent gains in early trading Friday. The August Nymex contract was down 1.9 cents to $1.766/MMBtu at around 8:45 a.m. ET.

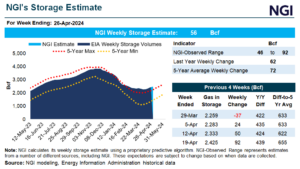

The Energy Information Administration (EIA) on Thursday reported a 37 Bcf injection into U.S. gas stocks for the week ending July 17. EIA reported a build of 45 Bcf for the week ending July 10.

The build lifted inventories to 3,215 Bcf, above the five-year average of 2,779 Bcf.

The latest result compares with a 44 Bcf storage build in the same week last year and a five-year average increase of 37 Bcf.

“Following the same trend as prior weeks, yesterday’s in-line print drove outsized price action, this time to the upside,” analysts at Tudor, Pickering, Holt & Co. (TPH) said. With the build falling in line with consensus and with degree days also close to historical norms, the print was “about as boring as it gets from a market perspective.

“However, the price action thought otherwise,” the TPH team said. “While it’s hard to say what the catalyst for the move was, we see the probability of hitting storage capacity becoming increasingly unlikely, which could help put a floor on price.”

TPH estimates show storage peaking at 4.08 Tcf this year, but supply is running 1 Bcf/d below its forecasts, which would free up an additional 100 Bcf of wiggle room, the analysts said.

“Additionally, record power burn this week is lining up for a tight print next week, with our early modeling pointing to a build in the 20 Bcf range, about half of normal levels,” they said.

As for the latest guidance, Bespoke Weather Services observed “very little change” day/day in terms of the temperature outlook, suggesting an end to a recent run of cooler-trending shifts in the models.

“As we have pointed out, even with the cooler changes, the forecast continues to call for above normal heat for the nation as a whole in the 15-day forecast, with a dip toward normal at the very end of this month,” Bespoke said. “We do not see any extreme heat on the horizon, but we do feel August turns out to be another hot month compared to normal.”

Meanwhile, storm activity in the Atlantic has been “heating up,” presenting “another wildcard to consider” as a possible influence on temperatures for any storms that impact the United States, Bespoke said.

The National Hurricane Center (NHC) early Friday was monitoring Tropical Storm Hanna, located about 285 miles east of Corpus Christi, TX, and carrying maximum sustained winds of 40 mph.

“Hanna is moving toward the west-northwest near 9 mph and a turn toward the west is expected tonight, followed by a generally westward motion through the weekend,” the NHC said. “On the forecast track, the storm center should make landfall along the Texas coast” on Saturday.

Hanna is expected to gradually strengthen until making landfall, according to the forecaster.

Further out in the Atlantic, Tropical Storm Gonzalo was threatening the southern Windward Islands as it charted a westward to west-northwestward course.

“On the forecast track, the center of Gonzalo will approach the southern Windward Islands tonight and then move across the islands on Saturday and over the eastern Caribbean Sea on Sunday,” the NHC said.

September crude oil futures were up 34 cents to $41.41/bbl at around 8:45 a.m. ET, while August RBOB gasoline was up fractionally to $1.2680/gal.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |