Markets | Natural Gas Prices | NGI All News Access

Natural Gas Futures Ease Lower as Seasonal Temperatures Expected Late Month

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |

Earnings

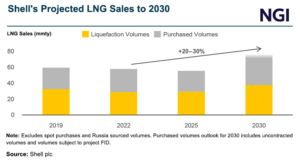

Anyone wanting to perfect the basic fundamentals of trading and optimizing LNG sales on the global market probably need look no further than to Shell plc. The No. 1 global liquefied natural gas trader, and Europe’s leading oil and gas producer, overcame slumping commodity prices during the first quarter to deliver increased production and higher…

May 2, 2024Natural Gas Prices

By submitting my information, I agree to the Privacy Policy, Terms of Service and to receive offers and promotions from NGI.